Accept crypto with CoinGate

Accept crypto with confidence using everything you need in one platform.

Is Bitcoin Real Money? Let's Find out.

If money is just a made-up social construct of trust, why can’t Bitcoin be money?

The thing is, it actually can.

Bitcoin is going strong for almost 12 years now, showing no signs of going away. Quite the opposite – the network seems the strongest it ever was after passing its ATH, and even institutional investors are finally starting to accept the Bitcoin standard, as we predicted before.

MicroStrategy, Square, Ruffer – those are just a few pioneering companies and investment funds that allocated a significant portion of their funds to Bitcoin already, but certainly not the last ones.

Reasons for doing so have been stated many times. The main reason for it is to counter fiat currency inflation and fight against its devaluation, and Bitcoin has everything to make that happen. However, Bitcoin is also much more than that.

Does Bitcoin have all the properties of money?

For something to be called “money”, it has to be able to serve as a medium of exchange, a unit of account and a store of value. To meet these requirements, money has to conform to certain criteria so that people could actually trust it and use it.

To go through these criteria, we will dig a bit deeper and figure out what makes money real.

This way, we can also determine whether Bitcoin has what it takes to be considered as a viable monetary unit (just not the kind that is backed by the government bodies).

So for money (or Bitcoin) to be medium of exchange, a unit of account and a store of value:

1. It has to be acceptable. Like a dollar or euro, you want to be able to spend it. Is Bitcoin accepted by merchants?

Yes. Lots of online stores take Bitcoin for payments, and more prominent brands are also easily accessible via gift cards. Besides, it’s easy to accept cryptocurrency payments with payment processors such as CoinGate.

2. It must be divisible. In other words, you have to be able to divide a monetary unit into smaller pieces, just like a euro or a dollar can be divided into 100 cents. Is Bitcoin divisible into smaller pieces?

Yes. Down to 8 decimal places, in fact.

3. It must be portable, so you can easily transfer it wherever it is needed. Is Bitcoin portable?

Yes. Even better, it doesn’t need any middlemen to be portable, but more about that later.

4. It must be durable because you want to use it many times over and over again without breaking it. Is Bitcoin durable enough?

You bet it is, and Bitcoin already has 11 years behind it to prove its immutability.

5. It should be limited in supply. Gold has this property as it is a scarce commodity, while the fiat currency’s scarcity is created artificially through the banking system. But is Bitcoin limited in supply?

Yes. There will never be more than 21,000,000 bitcoins and even less in the circulating supply.

If we take these points into consideration, Bitcoin appears to not only meet the requirements of “being money” but also to improve on what money is, and allow us to imagine what money could be in the future.

The only problem is, Bitcoin lacks one important property that money needs – fungibility.

Bitcoin is not fungible… yet

While your hundred-dollar bill is worth the same and acceptable everywhere regardless of its history, it does not apply to Bitcoin in the same way as every step of its history can be traced and tracked back to the day it was mined. Yes, bitcoin is not that private as it appears.

It means that if you ever obtain bitcoin that was in the hands of criminals at any point in time, your wallet might, for example, be blacklisted by exchanges just for that reason.

“Clean” bitcoin vs bitcoin that circulated in the Silk Road for quite some time is not the same, making it a non-fungible asset.

However, a little soft fork might solve Bitcoin’s fungibility problem. One of such proposals is Dandelion – a proposed privacy protocol for Bitcoin.

If implemented, it would leverage random pathways during the diffusion process following a transaction, when the network relays transactional details to all of its nodes.

As such, Bitcoin might become much more privacy-oriented than it is now, shutting down one of the last key points that argue against bitcoin being money.

Disregarding non-fungibility, bitcoin still is a superior monetary unit

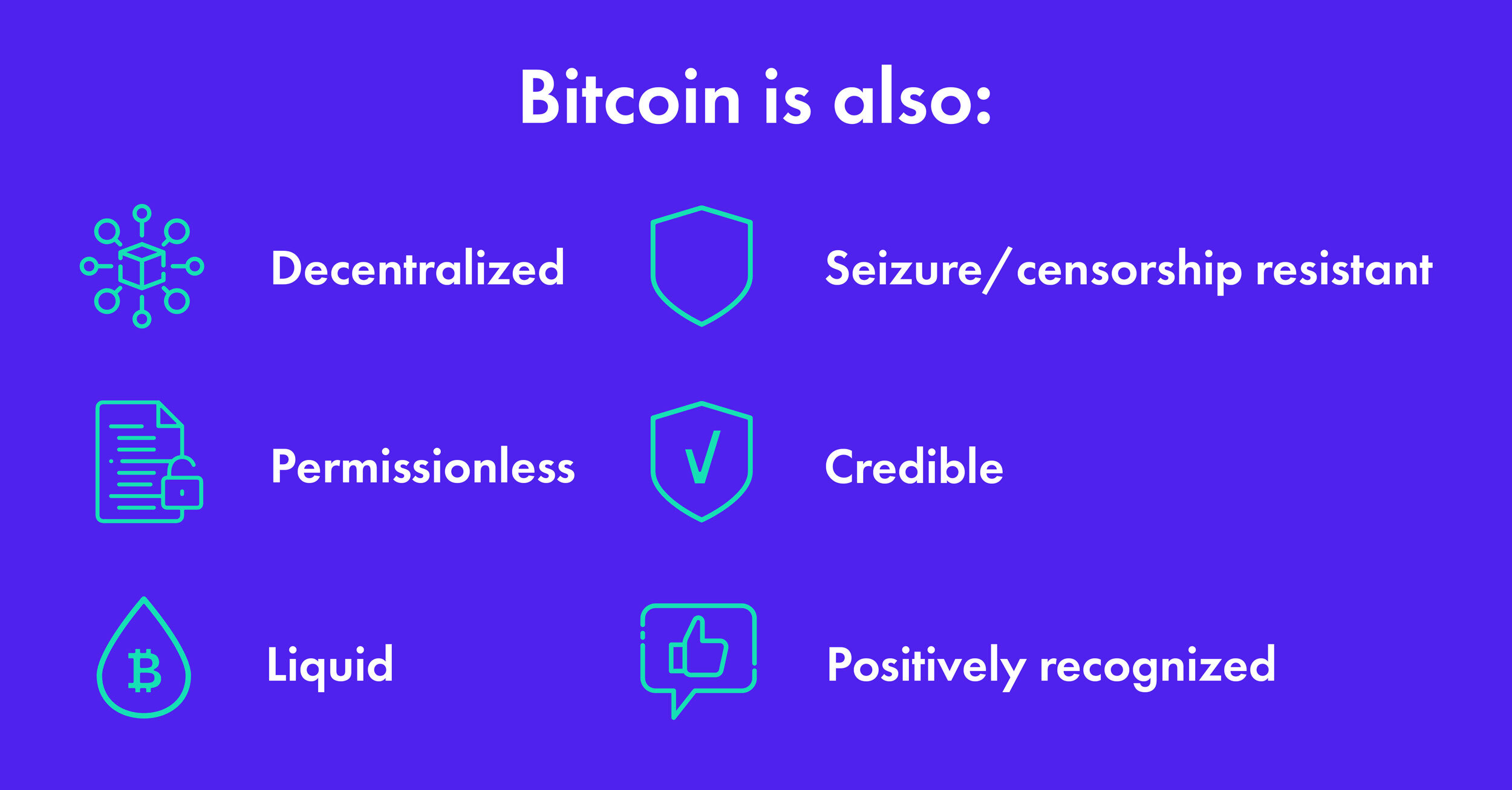

Despite fungibility issues, Bitcoin has incredibly sound fundamentals and properties designed not only to be money but also to protect wealth and retain freedom in people’s hands even if an unwelcome authoritarian figure attempts to threaten it.

For example:

- Decentralized p2p network. No bank or other middlemen are required for the Bitcoin network to keep on going because it is run by the independent network participants. That’s one of the reasons why Bitcoin has never had downtime and remains immutable since its inception.

- Seizure-resistant. If someone even suspects that you’re doing something with your fiat money that others may not like or approve of–believe it or not– it can be seized by authorities. In such situations, the principle of “guilty until proven innocent” often kicks in and there’s not much you can do with your frozen bank account. Bitcoin fixes it, at least if you hold it in self-custody. Although Bitcoin can still theoretically be seized, for example, by force, well-hidden private keys makes it way more complicated.

- Censorship-resistant. Those that hold power to inflict censorship will do so sooner or later on some level, especially in countries where governments hold more power than they are supposed to. However, Bitcoin can bypass censorship even if the internet itself is being censored. Bitcoin fixes it.

- Digital, global, permissionless. Have Bitcoin on any device, use it from any location in the world whether the government likes it or not, and don’t ask anyone whether you can or can’t do it. What else is there to say?

- Credible and sound monetary policy. Hyperinflation of fiat currencies is not so uncommon – just look at the cases of Venezuela, Zimbabwe, Argentina, etc. However, deflationary nature of bitcoin’s supply, mining difficulty adjustments and four-year halving cycles seems to be the recipe to counter fundamental issues of fiat currencies that can possibly inflate to infinity.

- It has high liquidity – there’s never a problem to buy bitcoin, or sell it for whatever asset or commodity you wish to own. High liquidity also brings stability to an asset’s price, which most people tend to appreciate. In fact, lately Bitcoin has been more stable than most traditional assets.

- Recognition. Bitcoiners are very vocal and there is plenty of content that they produce in order to spread the word, teach and pave the way for newcomers.

Bitcoin IS money, but very young

Bitcoin is an innovation which thrives on adoption, and vice versa. While the perception always makes the truth, and perception of Bitcoin is getting more positive with each day passed as opposed to fiat currencies, it is hard to imagine any other future for Bitcoin than a bright one.

Therefore, Bitcoin might as well grow up to become the best monetary system for the 21st century and perhaps beyond.

Accept crypto with CoinGate

Accept crypto with confidence using everything you need in one platform.