Accept crypto with CoinGate

Accept crypto with confidence using everything you need in one platform.

The 3rd Bitcoin Halving Is Here: What Happens Next?

On the 11th of May, 2020, Bitcoin’s blockchain went through a historic process called the block reward halving. Once it passed, the network started rewarding miners with 50% fewer bitcoins for verifying blocks and securing the Bitcoin’s decentralized network.

The Bitcoin halving is a pre-programmed event that occurs every 210,000 mined blocks or roughly every four years. After the network approached the 630,000 block mark, the miner’s reward decreased by half for the third time in history – from 12,5 coins per block to 6,25 coins per block.

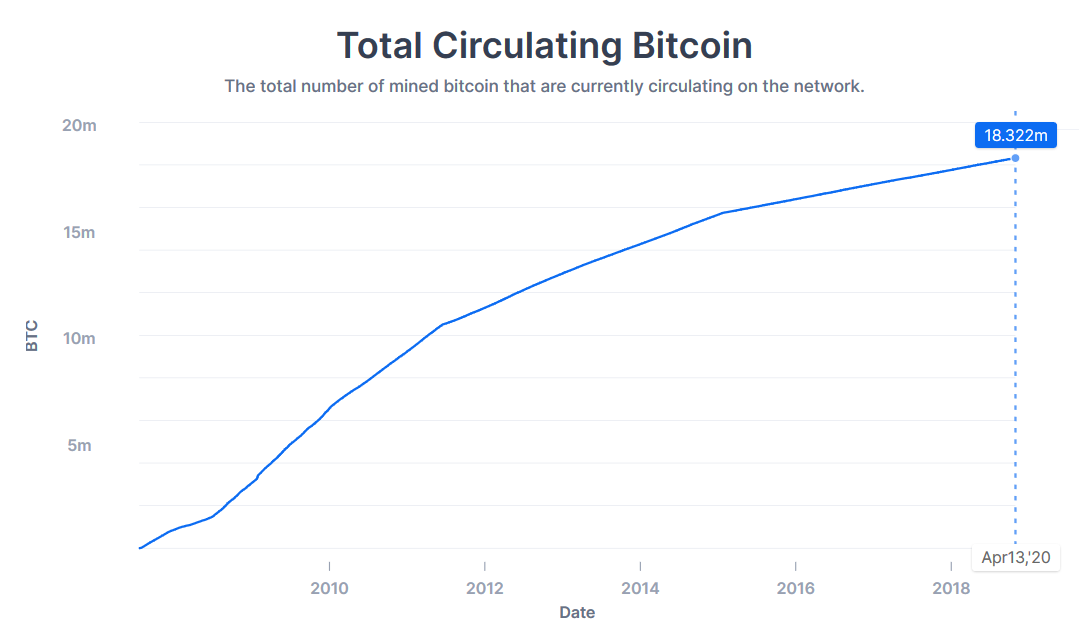

Halvings will continue to happen at the same pace until all 21,000,000 bitcoins that can exist will be mined. It is expected to happen somewhere around the year 2140. That means less and less new bitcoins will flow into the market as time goes by.

It’s essential to recognize that Bitcoin is designed as a deflationary currency, which implies that the demand for Bitcoin should grow over time while the issuing of new coins continuously slows down before it stops completely.

If so, in the long term, the 3rd halving, as well as all the following ones, should theoretically result in the rise of Bitcoin’s value and the diminishing of its inflation rate.

History shows that it’s precisely what happened after previous halvings. Is this time going to be any different? Nobody knows. But one thing for sure – it caught the attention of many during global unrest, which makes the aftermath of 3rd halving less predictable and possibly more impactful than before.

Stock up on Bitcoin before the aftermath kicks in!

Here’s our best guess at what’s going to happen next:

More people might get involved after Bitcoin halving

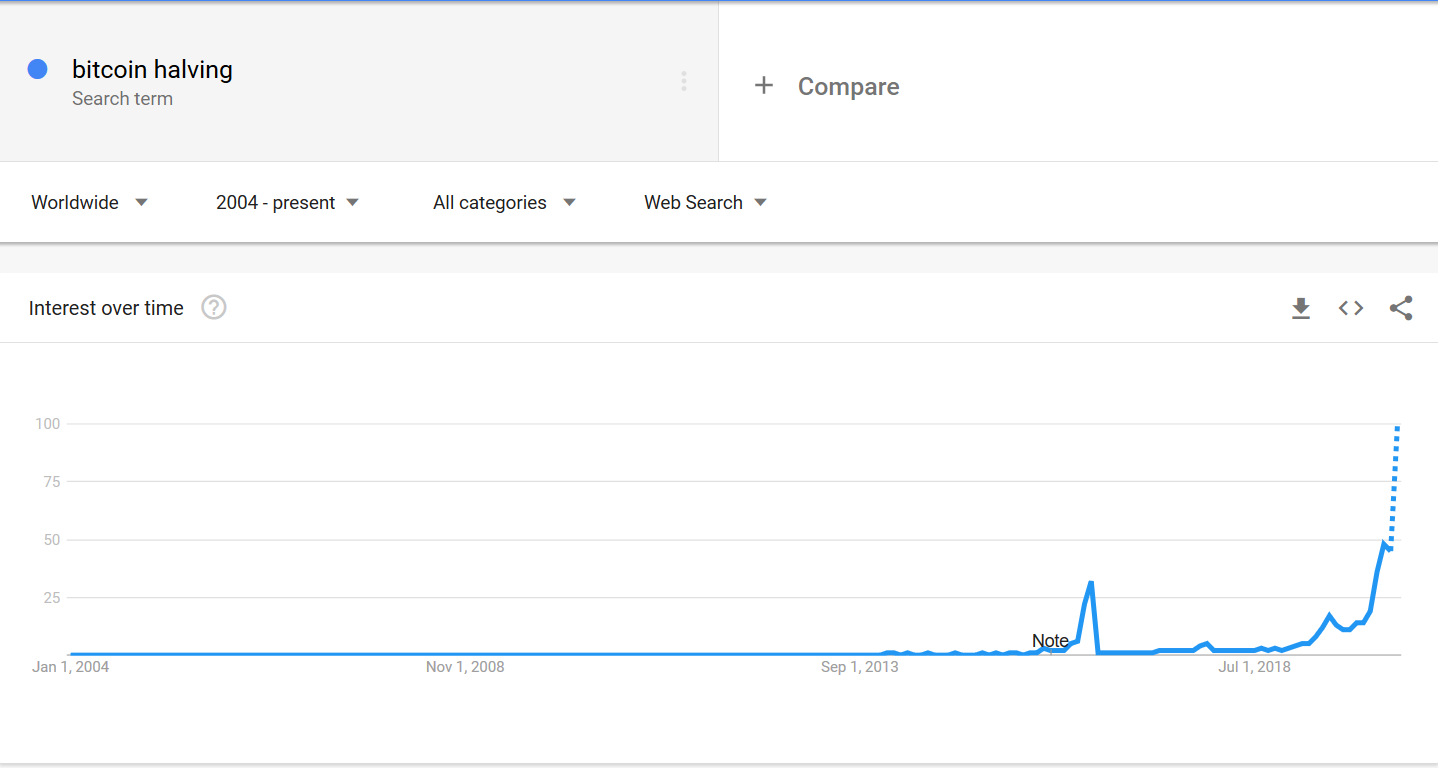

Without a doubt, the general perception of Bitcoin is maturing as more individuals, businesses, investors and organizations than ever before keep a close eye on it.

But more importantly, the general public keeps talking about it, which often turns into word-of-mouth advertising by the dinner table.

The media also seems to cover the 3rd Bitcoin halving event much more than the previous ones. The continuous buzz mixed with widespread public discussions and endorsements might naturally draw more people to it, as it happened times and times before.

And most likely, those people that have been carefully watching it from afar these past years but never took action will be the first in line.

Considering the ongoing COVID-19 crisis and the uncertain future of the world’s economy, the fear of missing out might be the most significant catalyst. After all, Bitcoin has already proved itself over the years as a safe alternative for value storing, at the very least.

Besides, since it’s not the first halving event, the crypto crowd is now more experienced. It leads to believing that most Bitcoin veterans will avoid making past mistakes, like panic-selling during the expected volatile periods, which is possible because…

Bitcoin halving will force some miners to shut down, which bears consequences

The reality is, miners have a lot of expenses they can’t cover with bitcoins. They have to keep the mining rig up-to-date, pay rent and, more importantly, cover the electricity costs every month.

In general, Bitcoin mining requires a lot of investment and maintenance. As such, turning some profits into fiat is inevitable for the majority of miners.

However, their salary is now halved, which sounds as bad as it is. If the price of bitcoin won’t increase and remains similar as it is now ($7,064 at the time of writing), miners that utilize more expensive electricity or have outdated hardware might have to shut down as they won’t be able to keep up with the expenses.

Even though most believe that Bitcoin halving was already priced in because all miners plan their investments ahead of time, there’s no actual way to be sure of it. Miners becoming unexpectedly bearish months after the halving remains a possibility, which could be the reason for a sudden price drop.

Wait, there’s more…

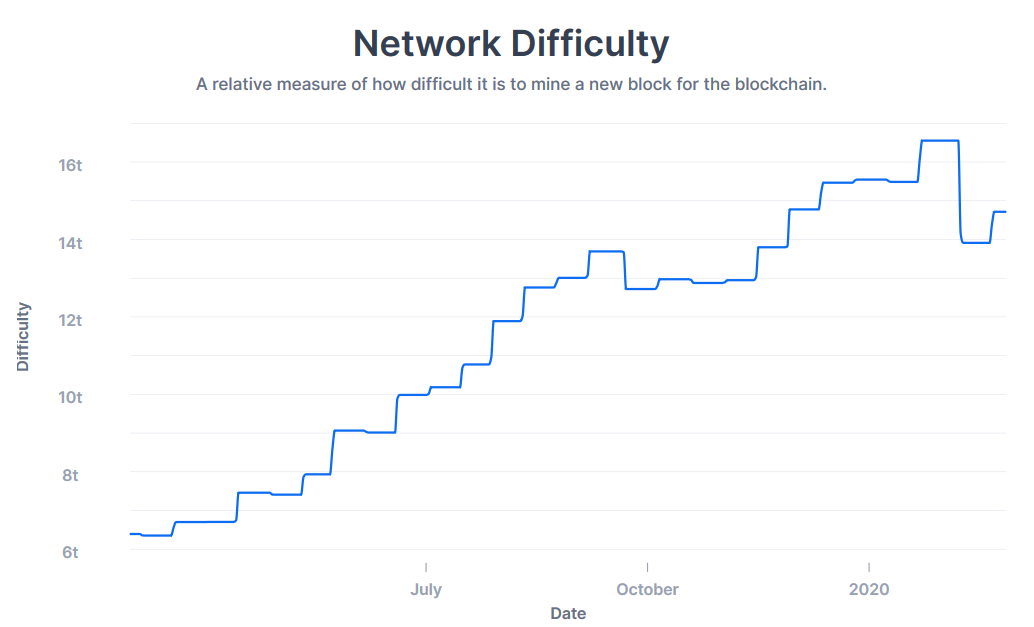

But there might be other consequences. A sudden drop in the network’s hash rate would make the average block confirmation time longer. That would result in slower confirmation of Bitcoin transactions. Slow transactions could potentially lead to a backlog of them, which would also lead to higher average network fees.

However, this situation would be temporary. Over a few weeks, the difficulty of mining would adjust accordingly, meaning that less computational power would be needed to mine blocks.

Let’s also not forget that in time, new mining hardware will enter the market and sources of cheaper, cleaner electricity will become more accessible. Considering that, it’s safe to say that this segment of the industry will always adapt and survive.

Best case scenario, the price of Bitcoin will skyrocket, and no miners will have to take a break. We are yet to see if that happens.

Will Bitcoin remain safe if many miners leave the network after halving?

No matter how many miners will stop their operations, it will result in less decentralization for the Bitcoin’s network. If it’s a tragedy or not heavily depends on the number of miners leaving.

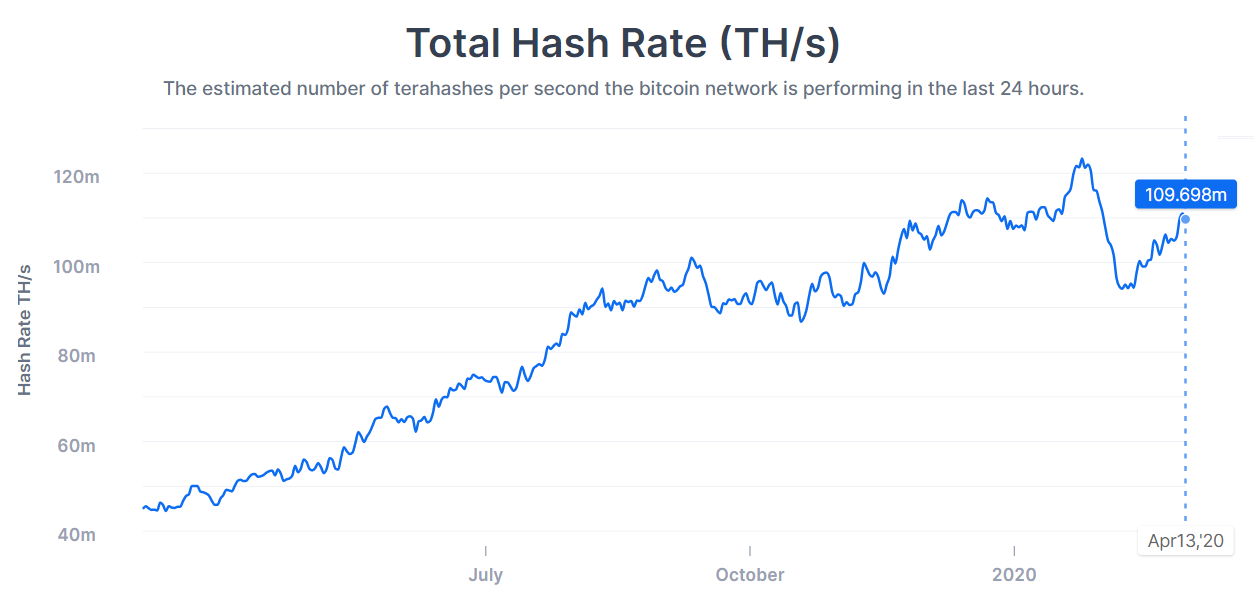

However, at this point, it’s nearly impossible that Bitcoin will ever become vulnerable enough to attacks like double-spending as the network hashrate is around 109,000,000 terahashes per second.

Simply said, one entity would need to control 51% of that to perform a double-spend on the Bitcoin’s network reliably. And that’s a terribly expensive, inefficient and inconvenient thing to attempt to pull off.

So if there’s one thing we can predict, there’s nothing to worry about when it comes to blockchain’s immutability during or after the event of halving.

As long as Bitcoin lives, mining will never become irrelevant

Are you considering to start mining and support the decentralization of the Bitcoin blockchain?

One of our merchants, NuVoo, provides Bitcoin cloud mining solutions that run on 100% green energy and provide competitive electricity fees.

A company is also beginner-friendly and utterly transparent about mining activities. Something worthwhile to try out while dipping your toes into the crypto industry for the first time.

What do you believe will be the outcome of the upcoming Bitcoin halving event? Do you agree with us or disagree? Let us know on this Twitter post! You can also subscribe to our blog down below for more content like this.

Accept crypto with CoinGate

Accept crypto with confidence using everything you need in one platform.