Accept crypto with CoinGate

Accept crypto with confidence using everything you need in one platform.

5 Best Crypto Tax Software in 2026

With the best crypto tax software, users can save time, reduce errors, and ensure they meet their tax obligations accurately and on time.

Knowing how to calculate crypto tax may seem like a daunting task, but with the best software, you’ll never have to worry about making the wrong tax returns again.

What is Crypto Tax Software?

Crypto tax software is a specialized set of digital tools designed to help cryptocurrency users accurately calculate and report their taxes.

These platforms automatically import transaction data from various exchanges and wallets, compute gains and losses, and generate detailed tax reports compliant with regulatory standards.

That’s where we can help.

In the following article you will learn about five of the best tax software for crypto in 2026, all accept crypto for payments:

You’ll also discover why – whether you’re an individual, an organization, or an investor – you need crypto tax software, what it does, the dangers of not having it, and a lot more.

So, without further ado, let’s get started.

Why Do You Need The Best Tax Software for Crypto?

Cryptocurrency transactions can be highly complex, involving multiple exchanges, wallets, and types of activities such as trading, staking, and lending.

Keeping track of all these transactions manually can be overwhelming and might even be prone to errors when it comes to tax filing.

But don’t worry, a good crypto tax platform simplifies this process by automating data import and calculations.

It also helps you understand how to correctly calculate crypto tax, ensuring you comply with tax regulations and avoid penalties, and making the necessary calculations for gains, losses, and tax liabilities.

Hardware Wallets:

What Does Crypto Tax Software Do?

Crypto tax software performs several key functions:

- Transaction Import: Automatically imports transaction data from exchanges, wallets, and other platforms.

- Tax Calculations: Computes capital gains, profits, losses, and income from various crypto activities.

- Reporting: Generates tax reports that are compliant with local tax authorities, such as the IRS, HMRC, and others.

- Portfolio Tracking: Offers tools to track the value and performance of your crypto portfolio over time.

Best Crypto Tax Software For You

In the following sections, we’ll provide a detailed crypto tax software comparison, highlighting the features, pricing, and benefits of the 5 best crypto tax software options in 2026, Koinly, ZenLedger, BlockPit (formerly Accointing), Divly, and CoinLedger.

Koinly

Koinly is a powerful cryptocurrency tax tool that makes it easy for individuals, businesses, and accountants to track and report their crypto transactions.

Koinly lets you effortlessly track your crypto assets and taxes while also delivering an accurate and up-to-date crypto tax report.

Whether you’re managing personal investments or handling a maze of transactions for clients dotted around the world, Koinly’s toolbox of easy-to-use features makes it an indispensable companion for crypto tax compliance.

Key Features

Transaction Import

- Automated Data Import: Connect your accounts via API, add BTC wallets using x/y/zpub keys, and import ETH tokens with your public address.

- Margin & Futures Trading: Supports margin trading on platforms like BitMEX, Binance, and Kraken.

- Staking, Lending & DeFi: Recognizes and tags income from platforms like Nexo, Compound, and Lido.

- Smart Transfer* Matching: Uses AI to detect and exclude transfers within your wallets from tax reports. *(Smart transfers are reusable templates with saved transfer settings)

Tax Calculations

- Actual ROI and Invested Fiat: Displays how much you have invested in your coins.

- Income Overview: Provides an overview of mining, staking, lending, and other crypto income.

- Profit/Loss & Capital Gains: Shows realized and unrealized capital gains, helping you see your profit or loss.

Reporting

- Reliable Tax Reports: Preview tax liabilities for free and download complete reports when ready to file.

- IRS Form 8949, Schedule D: Pre-filled IRS tax forms for US users.

- ATO myTax Report: Supports Australian income tax and capital gains tax, factoring in the 50% long-term CGT discount.

- HMRC Capital Gains Summary: Calculates capital gains and losses for UK users.

- CRA Schedule 3: Uses the approved adjusted cost basis method for Canada.

- International Tax Reports: Generates tax reports for various countries including Ireland, South Africa, India, and more.

- Integration with Tax Software: Easily export transactions to TurboTax, TaxAct, and H&R Block.

Pros and Cons

Pros

- Comprehensive Coverage – Supports 23,000+ cryptocurrencies, 170+ blockchains, 400+ exchanges, 100+ wallets, and 30+ services.

- User-Friendly – Automated data import and smart transfer matching make it easy to use.

- Accurate Reporting – Reliable tax reports with options for international tax compliance.

- Problem-Solving Tools – Double-entry ledger system, error highlighting for missing transactions, auto import verification, and duplicate handling.

Cons

- Pricing – Some advanced features may be locked behind higher-tier plans, which might be costly for casual users.

- Complexity for Beginners – While powerful, the range of features might be overwhelming for new users unfamiliar with crypto tax concepts.

Pricing and Plans

Koinly offers a range of pricing plans to suit different needs:

- Free Plan: Allows users to track up to 10,000 transactions and preview tax reports.

- Newbie Plan: $49/year for up to 100 transactions.

- Hodler Plan: $99/year for up to 1,000 transactions.

- Pro Plan: $199/year for up to 10,000 transactions.

- Custom Plan: Available for more than 10,000 transactions, with tailored pricing.

All plans come with a 30-day money-back guarantee, ensuring satisfaction with the service.

Why Koinly Stands Out

Koinly’s ability to sync data from an extensive range of exchanges, wallets, and services ensures that users can manage all their crypto transactions in one centralized place.

Automated import and smart transfer matching simplifies and streamlines the process, reducing the risk of errors.

Additionally, Koinly’s advanced tax reporting options cater to users from multiple countries, making it a versatile solution for global crypto tax compliance.

The platform’s proven problem-solving tools further increase its reliability, making sure that users can confidently prepare accurate and compliant tax reports.

By choosing Koinly, users gain access to a powerful crypto tax tool that simplifies the complexities of crypto tax reporting.

This versatility makes Koinly the perfect crypto accounting solution for individual investors and professionals managing multiple clients.

ZenLedger

ZenLedger is a leading cryptocurrency tax calculator that simplifies the process of calculating DeFi, NFT, and crypto taxes while also allowing users to file their taxes directly within the app.

Known for being one of the most comprehensive cryptocurrency tax calculators on the market, ZenLedger helps users easily calculate their cost basis and capital gains, making tax season less stressful.

Key Features

Transaction Import

- Comprehensive Import Support: ZenLedger supports over 400 exchanges, 100+ DeFi protocols, and 10+ NFT platforms, allowing users to seamlessly import their entire trading history.

- Automatic Calculation: Once transactions are imported, ZenLedger automatically calculates cost basis, fair market value, and gains/losses.

Tax Calculations

- IRS SCHEDULE 1 (Crypto Income Report): Generates statements that provide a comprehensive overview of all income, including from airdrops, forks, staking rewards, and DeFi.

- IRS SCHEDULE D (Capital Gains and Losses): Instantly calculates taxes and generates a Schedule D for easy crypto tax reporting.

- IRS FORM 8949 (Sales and Other Dispositions): Uses transaction history to generate an IRS Form 8949, essential for reporting capital gains and losses.

- Tax Loss Harvesting (TLH): ZenLedger’s dashboard allows users to offset capital gains with losses, potentially reducing their tax liability.

Reporting

- Grand Unified Accounting (GUA): The End-of-Year Valuation Report provides a detailed summary of all transactions, offering a comprehensive overview of holdings across multiple exchanges and wallets.

- Additional Reports: Includes Mining and Staking Income Report, Audit Trail Report, Margin Trading Report, Cryptocurrency Donations Report, Year-End Valuation Report, Crypto Income Report, Mining and Staking Revenue Report, Accountability Report, and Cryptocurrency Gifting Report.

Pros and Cons

Pros

- Comprehensive Integration – Supports a vast array of exchanges, DeFi protocols, and NFT platforms.

- User-Friendly – Simplifies the tax filing process with automated calculations and easy-to-generate reports.

- Advanced Tools – Features like Tax Loss Harvesting and the Grand Unified Spreadsheet enhance tax-saving strategies and transaction tracking.

- Premium Support – Offers 7-day support via chat, email, phone, or video calls.

Cons

- Pricing – Advanced features might be locked behind higher-tier plans, potentially increasing costs for users with extensive needs.

- Learning Curve – Despite its user-friendly design, the range of features and tools might require some initial learning for beginners.

Pricing and Plans

ZenLedger offers a variety of pricing plans to accommodate different needs:

- Free Plan: Ideal for beginners, allowing users to track and generate reports for up to 25 transactions.

- Starter Plan: $49/year for up to 100 transactions.

- Premium Plan: $149/year for up to 1,000 transactions.

- Executive Plan: $399/year for up to 5,000 transactions.

- Platinum Plan: $999/year for up to 15,000 transactions.

- Custom Plan: Available for users with over 15,000 transactions, with tailored pricing.

All plans include a detailed Tax Loss Harvesting report, premium support, and security features like two-factor authentication.

Why ZenLedger Stands Out

ZenLedger stands out due to its comprehensive support for a wide array of exchanges, DeFi protocols, and NFT platforms, making it an ideal solution for users with diverse cryptocurrency portfolios.

The platform’s tools, such as Tax Loss Harvesting and the Grand Unified Spreadsheet, lets users optimize their tax strategies and maintain detailed transaction records.

ZenLedger’s integrated approach gives users the freedom to calculate and file their taxes without leaving the app, streamlining the entire process.

As the icing on the cake, ZenLedger also provides premium customer support seven days a week, letting users navigate their crypto tax obligations with confidence and ease wherever and whenever they want.

Divly

Divly is built with European crypto investors in mind. Instead of just spitting out a generic summary, it creates country-specific reports with the actual tax forms you need, plus step-by-step filing instructions. That makes it a strong choice for anyone who wants peace of mind when dealing with crypto taxes.

Key features

- Coverage for 20+ EU countries with localized forms

- Global Tax Report available for users outside Europe

- Imports data from 150+ wallets and exchanges

- Clear filing instructions for each supported country

- Supports multiple cost basis methods (FIFO, LIFO, average, etc.)

Pros and cons

Pros:

- Strong European focus with localized compliance

- Simple one-time pricing per tax year

- Seasonal discounts available

- Easy to use, even for beginners

Cons:

- Limited coverage outside Europe (reliant on Global Report)

- Some users report minor issues with certain blockchain imports (e.g., Solana)

Pricing and plans

Divly uses a one-time pricing model, so you only pay when you need a report:

- Free (€0) – Portfolio tracking for up to 25,000 transactions, unlimited wallets and exchanges, supports DeFi, NFTs, futures, and 10,000+ cryptocurrencies.

- Casual (€49) – Local tax report for up to 150 transactions, unlimited updates, filing instructions, and a tax dashboard.

- Enthusiast (€99) – Local tax report for up to 1,500 transactions, plus dual citizenship support and everything in the free plan.

- Pro (€179) – Local tax report for up to 4,000 transactions (with options to scale to 10,000, 25,000, or unlimited), priority support, dual citizenship, and everything in the free plan.

Why Divly stands out

Divly’s real strength lies in its localization. If you live in Europe, it doesn’t just give you numbers—it gives you the exact forms your tax authority expects. Combine that with its focus on simplicity and straightforward pricing, and you get a tool that feels tailor-made for EU crypto investors.

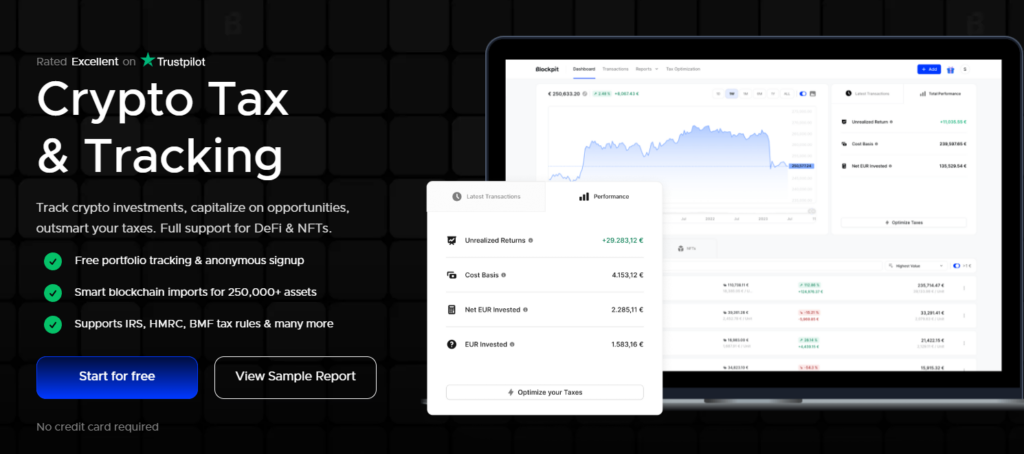

Blockpit

Blockpit – formerly Accointing – offers free portfolio tracking and anonymous signup, making it easier than ever to track crypto investments.

With smart blockchain imports for over 250,000 assets, users can efficiently manage their holdings.

The platform supports IRS, HMRC, BMF tax rules, and many more, ensuring compliance across different jurisdictions. Additionally, Blockpit connects users with a community of tax professionals, providing access to expert advice and support.

Plus, Blockpit lets users download their Accointing history file, preserving their crypto tax history up to December 31, 2023.

Blockpit enhances the user experience with improved features, allowing for continued effortless management of crypto taxes.

The platform also provides comprehensive crypto tax and tracking solutions, including full support for DeFi and NFTs.

Key Features

Transaction Import

- Seamless Data Migration: Users can download the “Complete History” CSV file from Accointing and import it to Blockpit, ensuring all existing exchange and wallet integrations are transferred.

- Automated Data Sync: Re-enter integration API keys and public keys to enable continuous automated data synchronization.

- Comprehensive Support: Supports over 250,000 assets, wallets, exchanges, and blockchains, covering all types of crypto transactions, including NFTs, DeFi, staking, and mining.

Tax Calculations

- Tax Optimization: Discover tax-saving opportunities with tax-loss harvesting to maximize crypto earnings while staying compliant.

- Accurate Reporting: Generate country-specific crypto tax reports with detailed transaction overviews, ensuring peace of mind during tax season.

Reporting

- Crypto Tax Report in 3 Steps:

- Create Your Free Account: New users receive free access to full tax licenses of the highest tier for all tax years prior to 2023.

- Import Data: Import Accointing data to Blockpit by downloading and uploading the “Complete History” CSV file.

- Reconnect APIs/Public Keys: Re-enter API keys and public keys for automated data sync.

Pros and Cons

Pros

- Seamless Migration – Easy transfer of data from Accointing to Blockpit with dedicated customer support.

- Comprehensive Support – Supports a vast range of assets, wallets, exchanges, and blockchains.

- Free Tax Licenses – Provides free access to highest-tier tax licenses for all years prior to 2023.

- Advanced Features – Includes portfolio management, tax optimization, futures and margin trading, and NFT & DeFi solutions.

Cons

- Pricing – Advanced features and higher transaction limits require more expensive plans.

- Re-entry of API Keys – Users need to re-enter API and public keys for automated data sync after migration.

Pricing and Plans

Blockpit offers a variety of pricing plans tailored to different needs, all covering unlimited integrations and including tax optimization tools and advanced performance indicators:

- Lite Plan: $49/year for up to 50 transactions.

- Basic Plan: $109/year for up to 1,000 transactions.

- Pro Plan: $269/year for up to 25,000 transactions (most popular).

- Unlimited Plan: $639/year for up to 500,000 transactions.

Each license covers one tax year and includes unlimited integrations, portfolio tracking, tax optimization, and support for various types of crypto transactions.

Why Blockpit Stands Out

Blockpit stands out due to its seamless migration process from Accointing, ensuring users can retain their crypto tax history and continue managing their taxes with enhanced features.

The platform’s comprehensive support for a wide array of assets, wallets, exchanges, and blockchains makes it a versatile choice for users with diverse crypto portfolios.

Additionally, Blockpit’s advanced features, such as tax optimization and detailed transaction overviews, provide valuable insights and help users capitalize on tax-saving opportunities.

With free access to highest-tier tax licenses for previous years and a strong community of tax professionals, Blockpit offers top-tier support and resources for managing crypto taxes effectively.

CoinLedger

CoinLedger is a cryptocurrency tax software designed to save users time and maximize their tax refunds.

As an official TurboTax partner, CoinLedger provides a seamless experience for both tracking crypto investments and filing taxes.

With international support and a free portfolio tracking feature, CoinLedger is built to make tax season stress-free and efficient for crypto investors worldwide.

Key Features

Transaction Import

- Easy Import: Supports importing transactions from popular exchanges like Coinbase and wallets like MetaMask with a simple click.

- NFT Integration: Users can enter their wallet address to pull all NFT transactions directly from the blockchain.

Tax Calculations

- Automatic Classification: CoinLedger automatically classifies transaction history into the appropriate tax treatment, with options for manual adjustments.

- Cost Basis and Historical Prices: Tracks the cost basis of assets as they move between wallets using CoinLedger’s historical pricing engine.

Reporting

- View Gains & Losses: Users can view their capital gains and income for free before paying for a tax report.

- Downloadable Tax Reports: After completing the necessary steps, users can download comprehensive tax reports with a single click.

- Export Options: Allows users to upload their tax reports to platforms like TurboTax, TaxAct, H&R Block, TaxSlayer, and more.

Pros and Cons

Pros

- Time-Saving – Automates transaction classification and tax report generation.

- Free Features – Offers free portfolio tracking and a preview of tax reports.

- Comprehensive Integration – Supports a wide range of exchanges, wallets, and NFT transactions.

- Customer Support – Provides support via email and chat, ensuring users get the help they need.

Cons

- Pricing – Some advanced features may require a paid plan.

- Learning Curve – New users may need some time to familiarize themselves with all features and functionalities.

Pricing and Plans

CoinLedger offers several pricing plans to accommodate different user needs. All reports are a one-time purchase per tax season, covering reports available from 2010 to 2023. Additionally, each plan comes with a 14-day money-back guarantee.

- Free Plan: $0 – Get started with basic features and free portfolio tracking.

- Hobbyist Plan: $49 – Ideal for casual investors with a small number of transactions.

- Investor Plan: $99 – Suitable for regular investors with a moderate number of transactions.

- Pro Plan: $199+ – Designed for advanced users and professionals with extensive transactions.

Specific pricing details are available on the CoinLedger website, ensuring flexibility and affordability for all types of crypto investors.

Why CoinLedger Stands Out

CoinLedger stands out due to its user-friendly design and comprehensive feature set, making it a go-to solution for crypto investors during tax season.

The platform’s ability to automate the import and classification of transactions, coupled with its robust historical pricing engine, ensures accurate tracking of cost basis and gains/losses.

CoinLedger’s partnership with TurboTax and support for other major tax platforms make it easy for users to upload their tax reports directly. Additionally, the free portfolio tracking and tax report preview offer significant value, while the educational resources and responsive customer support further enhance the user experience.

With a proven track record of processing $70 billion in transactions and saving users $50 million through tax-loss harvesting, CoinLedger is a trusted and reliable choice for managing crypto taxes efficiently.

Benefits of Using Crypto Tax Software

Using the best crypto tax software offers a whole spectrum of benefits that make managing your cryptocurrency taxes significantly easier and more efficient.

But what are those benefits?

First and foremost, accuracy is a major advantage.

Automated calculations greatly reduce the risk of errors that might occur with manual data entry, ensuring that your tax reports are precise and reliable – and won’t get you into trouble.

Time-saving is another key benefit.

Crypto tax software streamlines the process of gathering transaction data from various exchanges and wallets and simplifies the preparation of tax reports. This efficiency frees up valuable time you can spend on other important activities.

Managing compliance.

Compliance is crucial when dealing with tax authorities, and crypto tax software ensures that your reports are compliant with the latest tax regulations. This reduces the risk of penalties and audits, giving you peace of mind.

Peace of mind.

Finally, using crypto tax software provides peace of mind. Knowing that your crypto taxes are handled correctly and efficiently reduces stress, particularly during tax season, and allows you to focus on your investments with confidence.

These tools offer tax optimization features that can identify opportunities for tax savings. For instance, strategies such as tax-loss harvesting can be easily implemented, potentially lowering your overall tax liability.

Pitfalls of Not Having Good Crypto Tax Software

Failing to use a good crypto tax tracking software can lead to several issues:

- Errors and Omissions: Manual tracking is prone to mistakes, leading to inaccurate tax reports.

- Non-Compliance: Incorrect or incomplete reporting can result in penalties and fines from tax authorities.

- Missed Opportunities: Without proper tools, you may overlook tax-saving opportunities.

- Increased Stress: Managing crypto taxes manually is time-consuming and stressful, especially as your transaction volume grows.

Choosing the right crypto tax software is essential for simplifying your tax reporting process and ensuring accuracy and compliance. Plus, while the cheapest crypto tax software might seem like good value, be sure to understand if what you’re getting really matches your needs.

Frequently Asked Questions About Crypto Tax Software

What is crypto tax software, and why do I need it?

Crypto tax software is a specialized tool designed to help cryptocurrency users accurately calculate and report their taxes. It automates the import of transaction data from exchanges and wallets, computes gains and losses, and generates tax reports compliant with regulatory standards.

You need it to simplify the complex process of managing crypto transactions and ensure compliance with tax regulations, thereby avoiding penalties and saving time.

How does crypto tax software work?

Crypto tax software works by automatically importing transaction data from various sources, such as exchanges and wallets, using API connections or CSV uploads.

It classifies these transactions according to their tax treatment and calculates your capital gains, losses, and income.

The software then generates detailed tax reports that you can use to file your taxes accurately. Many platforms also offer features like tax-loss harvesting, portfolio tracking, and integration with major tax filing services.

What are the potential pitfalls of not using crypto tax software?

Without good crypto tax software, you may encounter several issues. Manually tracking transactions is prone to errors and omissions, leading to inaccurate tax reports. Incorrect or incomplete reporting can result in non-compliance, penalties, and fines from tax authorities.

You may also miss out on tax-saving strategies like tax-loss harvesting. Furthermore, managing crypto taxes manually is time-consuming and stressful, especially as your transaction volume grows.

Why must I pay crypto taxes?

You must pay crypto taxes because cryptocurrencies are considered taxable assets by most governments.

When you engage in transactions involving cryptocurrencies—such as buying, selling, trading, or earning them through mining or staking—these activities are typically subject to tax regulations similar to those governing traditional financial transactions.

The tax authorities require you to report your crypto activities and pay taxes on any capital gains, income, or other taxable events to ensure compliance with the law. Failing to pay crypto taxes can result in penalties, fines, and legal consequences. Using crypto tax software can help you accurately calculate and report your taxes, ensuring you stay compliant with the regulations.

What are capital gains taxes?

Capital gains taxes are taxes imposed on the profit you earn from selling or disposing of an asset for more than you paid for it. In the context of cryptocurrencies, capital gains taxes apply when you sell, trade, or otherwise dispose of your crypto holdings at a higher price than your purchase price. The profit, known as the capital gain, is the difference between the sale price and the purchase price.

Using crypto tax software can help you track your transactions, calculate your capital gains accurately, and ensure you report them correctly to comply with tax regulations.

What are crypto tax reports?

Crypto tax reports are detailed documents that summarize your cryptocurrency transactions and calculate the resulting tax liabilities. These reports are used to accurately report your crypto activities to tax authorities, ensuring compliance with tax regulations.

Is free crypto tax software any good?

Free crypto tax software can be an option, especially for those with relatively simple tax situations or a small number of transactions. These tools often provide essential features such as transaction import, basic tax calculations, and reporting capabilities. However, it’s important to be aware that free versions may have limitations in terms of features, transaction caps, and customer support.

While many free tools are accurate and reliable, they might not offer the same level of assurance and compliance as premium tools, particularly for more complex tax scenarios. If you have a high volume of trades or need advanced features like tax-loss harvesting and support for complex transactions (e.g., DeFi, NFTs), investing in a paid version could be worthwhile to access more comprehensive features and better support.

Accept crypto with CoinGate

Accept crypto with confidence using everything you need in one platform.