Accept crypto with CoinGate

Accept crypto with confidence using everything you need in one platform.

Comparing Bitcoin vs Credit Card Payment Processor: What Method is Better for Merchants?

Nowadays, it is hard to find a vendor that wouldn’t accept credit or debit cards as currently, it is the most popular payment method in the world. However, the situation might change radically with Bitcoin entering the stage.

As people were slowly getting familiar with the blockchain technology, Bitcoin and other cryptocurrencies stepped in and proved themselves as a viable addition to the existing payment options. As a result, vendors get to enjoy some extra benefits that crypto brings to the table.

Even though digital assets might not be very common or convenient for everyday shopping just yet, they show a vast promise for several key reasons that we are going to talk about in this article.

Without further ado, let’s explore how cryptocurrency payments can benefit the vendor in ways that credit card payments cannot.

Cryptocurrency payments = significantly lower fees

It is a well-known fact that credit card payment providers are charging merchants interchange fees for processing payments. These costs can reach up to 3-4% from every purchase a customer makes. Moreover, card companies can adjust and add more fees on a whim without any warning.

Though this seems like a lot, there was never a decent alternative to choose from. Well, at least until now.

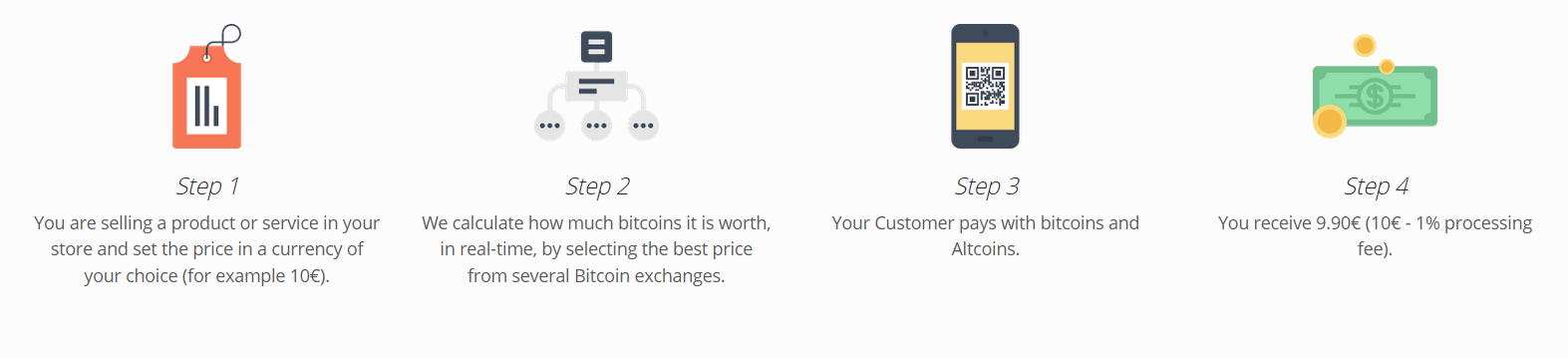

Today, merchants can accept blockchain-based payments by employing a decent payment provider that would convert their revenue to fiat currency. Such service costs way less than credit card processing, charging not more than 1% flat fee to cover processing costs.

In fact, that is what Kroger and Starbucks intend to do, signaling that even the big merchants are taking measures to find more efficient, cost-effective payment rails.

The good thing about cryptocurrencies is, they can make payment processing significantly cheaper. However, not all shoppers prefer paying with cryptocurrency, so for now, credit cards remain a necessary means of payment.

No fraudulent charges, no chargebacks

Chargebacks are the worst. If a bank issues a chargeback on debit or credit card (fraudulent or not), merchants will have to cover the cost of the reversed transaction. They will also waste their time and possibly suffer consequences like additional fees or various fines, as well as reputational damage.

On the other hand, accepting Bitcoin payments removes this problem whatsoever. As transactions on the Bitcoin blockchain are immutable and irreversible, there is no way for a customer to pull the money back to his account after the purchase has already been made.

Allowing to pay with cryptocurrencies is also beneficial from a security standpoint. The fact is, it is much easier to steal credit card information and make fraudulent purchases with it (which means that ultimately, the merchant will have to issue a refund) rather than to obtain a Bitcoin private key that doesn’t belong to you.

Simply said, stealing cryptocurrencies is much, much harder than credit cards. That is because when paying with cryptocurrency, a shopper doesn’t disclose his or her private information, whereas when you pay with a credit card, your personal data and the entire balance is revealed to the merchant, the acquiring bank, the card service, and the issuer.

Doesn’t sound too safe, right?

Serve customers worldwide

It is true that credit cards are accepted in most parts of the world. Still, a large portion of people doesn’t have access to the banking system. Despite that, anyone can use Bitcoin or any cryptocurrency (unless your government bans them) as long as the internet connection is on.

In other words, blockchain-based transactions are not bound to any country. They are also not affected by the national borders and doesn’t require any authority’s approval to be able to use it. A shopper can pay with Bitcoin from Japan to Norway without the need to wait long for a transaction to clear, convert one currency to another, or share personal data in the process. And all of this is possible without trusting a 3rd party.

Hence just by accepting cryptocurrency payments, you broaden your customer base by inviting crypto-enthusiasts from all over the world to shop at your place.

Providing an additional payment method to people that might prefer it in the first place can also suffice a powerful marketing tool.

The payment option that makes sales

All merchants accept credit cards, but not all accept payments in cryptocurrency. Luckily, you can take advantage of it.

Some people prefer spending digital assets more than anything else. In reality, just by letting your customers know that cryptocurrencies are welcome at your shop, you increase your chances to catch the attention of the right customer that otherwise would go somewhere else.

In fact, we have a whole blog post dedicated to effectively marketing your cryptocurrency payment options. It includes a free marketing material for your website, as well as tips & tricks you can use to boost your sales, improve customer experience, and elevate your business to new highs.

Check it out!

Free and easy setup

Setting up a cryptocurrency payment option at your store is easier than you might think, even if you compare it with usual payment methods. In fact, finding a decent credit card processor in some countries might be even impossible. Still, anyone can avail of cryptocurrency payments.

With some knowledge, you can also set it up on your own. Otherwise, it is best to employ a crypto payment provider.

For example, CoinGate offers a variety of different crypto payment integration methods. Each allows different customization options, but all of them give you the ability to accept over 50 cryptocurrencies with a single solution and the ability to convert the revenue to fiat currency.

Depending on the way you choose, it might take from 10 minutes up to a day to set everything up. Whether it’s a payment button, PoS, e-commerce plugin or API connection, the set up is free. In some cases, it does not even require any programming knowledge to execute.

If you would decide to look into it, we can offer our help and walk you through it.

Cryptocurrency 1:0 Credit Cards

Cryptocurrencies are still far from being a dominant payment method among merchants. And yet, they pose numerous advantages that the traditional payment methods like credit cards have lacked for decades.

Thus, we believe it is not a matter of if but when digital assets will become popular enough to replace traditional payment methods which currently avail of severely outdated technology.

Until that time comes, crypto payment methods might as well serve as an excellent addition to current payment options. After all, it is always better to prepare for the future in advance!

Accept crypto with CoinGate

Accept crypto with confidence using everything you need in one platform.