Accept crypto with CoinGate

Accept crypto with confidence using everything you need in one platform.

Comparing Crypto Brokerage vs Custodial Exchange: What’s Better For Fiat-to-Crypto Exchange?

If you’d ask someone what the best place to buy some Bitcoin or any other cryptocurrency for Euros is, you’d most likely be directed to one of the popular custodial exchanges.

Although going to places like Kraken or Bitfinex is not a wrong choice to make, there are numerous other ways to buy digital assets with fiat money that you may not be aware of. And those other options are quite different from the experience you would get when going through exchanges.

Even though not that widespread, you might also find that less-known crypto purchasing (or selling) methods can often be more attainable and convenient. It all ultimately comes down to your preferences, like how fast you want to deal with it, what lengths are you prepared to go, and how much you intend to trade overall.

With that said, today, we will delve deeper into differences between custodial exchanges and brokerage services like the ones we provide and focus specifically on operations involving fiat. Hopefully, it will shed some light on some more opportunities and possibilities available in today’s market.

Fiat deposits and withdrawals on an exchange

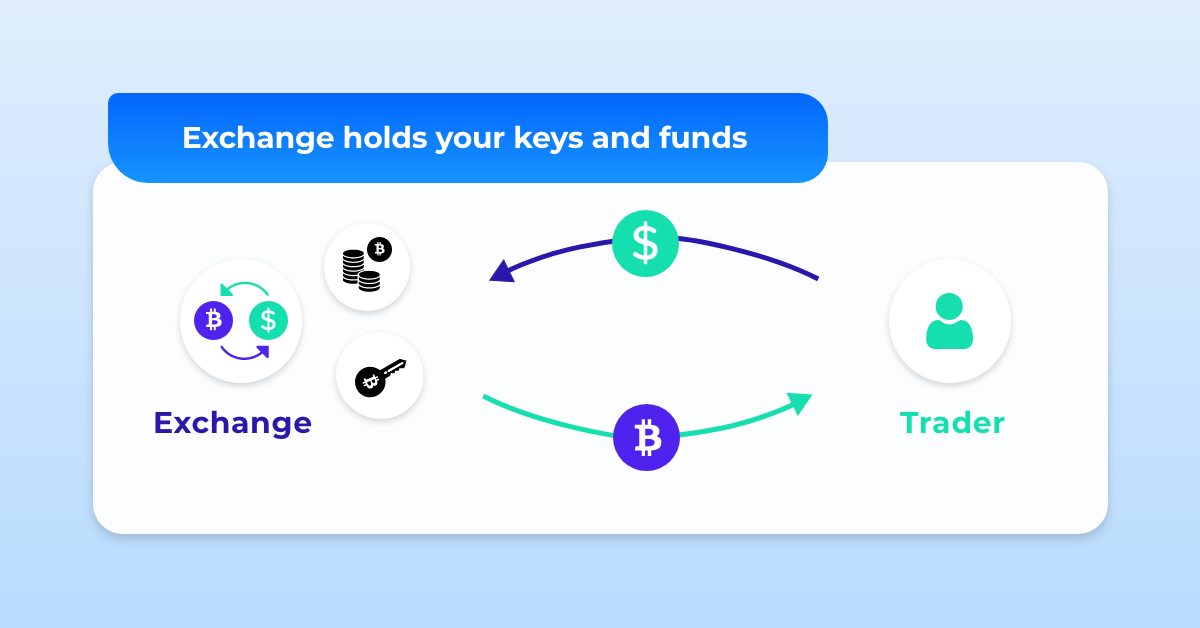

Exchanges work like this – you deposit currency of your choice to a custodial wallet of a service provider, make your order(s) and withdraw whatever you were seeking, or leave it there for future trades.

It’s perfect for day-to-day traders as crypto-to-crypto trading is very fast, market fees are decent, and there are hundreds of pairs to trade on. However, people that are new to crypto space who want to make one-time fiat trade might find it borderline confusing, time-consuming and costly, especially when it comes to depositing or withdrawing traditional currencies.

First off, fiat deposits on custodial exchanges usually (although not necessarily) have a few conditions to keep in mind. For example, the majority of exchanges require a minimum deposit amount, which also often carries a deposit fee. But, to make a deposit in the first place, you might also have to open a specific 3rd party bank account to be able to link it to your exchange account. And, after you make a fiat deposit, expect to wait 1-5 days for it to settle.

Then and only then you can make a trade on fiat-to-crypto pair (note that each trade also carries fees). But what if you’d want to exchange your cryptocurrency to fiat and then make a withdrawal?

As with deposits, the situation is similar to withdrawals as well. Every fiat withdrawal will have a minimum amount allowed to pull out, as well as hefty payment processing fee, and waiting time that can stretch out to 10 business days.

Fiat deposits and withdrawals at brokerage

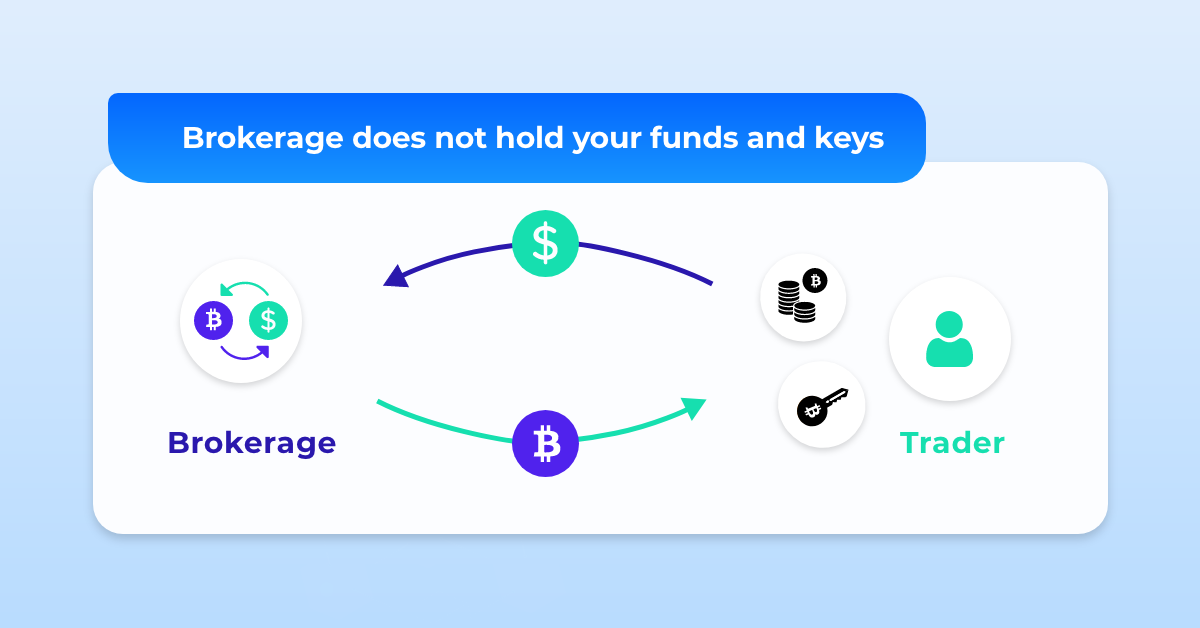

On the other hand, brokerage services such as our work a bit differently, whereas buying or selling digital assets for Euros only takes one payment to make, meaning there are no deposits or withdrawals per se. In general, CoinGate doesn’t allow depositing funds in the same fashion as exchanges because we do not hold our customer’s funds.

Instead, we take the current market’s rate, settle all trader transactions on-chain and make requested payouts in 24 hours to a bank account or personal crypto wallet.

For example, if you want to buy a particular cryptocurrency for Euros, all you have to do is indicate your wallet address and make a SEPA bank transfer. Right after your bank transfer reaches us, you will be able to commit to your purchase at any time or immediately. To avoid price fluctuations, we also fix the price at the moment of purchase.

Wire transfer is not the only way to obtain cryptocurrencies by making a single transfer. We also offer other methods, some of which do not require you to even have an account with us to buy digital assets with fiat.

For example, CoinGate allows buying cryptocurrencies with a debit or credit card and receive coins directly to a personal wallet of your choosing without creating an account. Instead, we apply the practice of the simplified KYC process.

Besides credit card payments and wire transfers, CoinGate customers can also buy cryptocurrencies with their mobile balance.

Safety of custodial exchanges

There’s a reason why most would recommend custodial exchanges as a go-to choice for obtaining cryptocurrencies with fiat. Not only is it the most popular option, but it might also seem more appealing for those new to crypto space as custodial exchanges lift the burden of securing your own private keys.

However, not having your private keys means that you choose to entrust your funds to exchange rather than taking matters into your hands. This opens up a possibility to lose your funds if an exchange gets hacked or finds itself in other unfortunate situations.

For example, last year, Binance suffered from a hack where hackers withdrew 7,000 Bitcoins worth about $40 million at the time via a single transaction in a “large scale security breach”.

Even though exchanges invest a lot in their security by establishing protective measures like separated servers, 2-factor authentication, advanced encryption technology, cold storages, DDoS protection and others, safety is not guaranteed as it still leaves them vulnerable to downtime issues, seizing, hacking or even bankruptcy.

Besides, there are other known instances where exchanges might crumble, such as market manipulation, insider trading, or failure to recognize forks when they happen.

Currently, almost 7% of all Bitcoin’s circulating supply is held by custodial exchanges, where all the transactions are tracked on a balance sheet instead of being verified directly on the blockchain. But, as the famous saying goes, “not your keys, not your coins”.

Safety of the brokerage

Although custodial as well, brokerage-type platforms like ours are inherently safer as we do not hold customers’ funds and do not store any private keys.

Every time a trader buys cryptocurrency on CoinGate using wire transfer, he then sends fiat to our bank account and we send cryptocurrencies to his private wallet. Every time he decides to sell assets for fiat, the payout will go straight to a bank account rather than CoinGate’s account.

However, to gain access to these services, all customers have to be identified to comply with regulatory requirements. It is something that cannot be avoided when dealing with fiat money, whether you’ll go to a brokerage or an exchange.

Fiat processing fee of custodial exchanges

As mentioned before, fees involving fiat procedures can be burdensome. Although they strongly vary from exchange to exchange and depend heavily on your jurisdiction, trading and withdrawing fiat from an exchange will be of limited possibilities and expensive, no matter which way you’d look at it.

For example, some well-known exchanges allow withdrawing fiat only when paying a minimum fee of 60$, plus a small percentage – meaning the more you withdraw, the more you will have to pay.

Fiat processing fee of brokerages

Whether you come to CoinGate to sell or buy fiat, the fee for processing SEPA requests is 3% flat. No additional fees are included in these services. However, if a new user comes to our platform via referral link, processing fee can be reduced to a mere 2%.

Conclusion

Exchanges are great if you intend to make trading a part of your daily routine. If you avoid involving fiat, crypto exchanges are probably the best place to settle down.

However, if you’re someone who’s looking for an inexpensive one-time trade with as little hassle as possible, platforms like CoinGate will do wonders for you.

Do you think that brokerages have advantages over custodial exchanges when it comes to fiat processing? Let us know on Twitter!

Accept crypto with CoinGate

Accept crypto with confidence using everything you need in one platform.