Accept crypto with CoinGate

Accept crypto with confidence using everything you need in one platform.

Mass Adoption of Blockchain Technology: 10 Signs of Widespread Acceptance

Even though the community’s level of interest is what often measures the success of cryptocurrencies, the real progress in the blockchain space is known to be made while the hype is down, and the silence is nigh.

In truth, the crypto industry is always restless. However, don’t take our word for it – several signs are showing that the future for cryptocurrencies, as well as the technology behind them, is bright, and we are here to prove it to you.

So, instead of arguing about bullish and bearish markets, or if all ICOs are scams, let’s focus on what is actually happening in the world that slowly, but steadily brings the blockchain to our daily lives.

In this article, we share ten reasons to believe that digital assets are taking over.

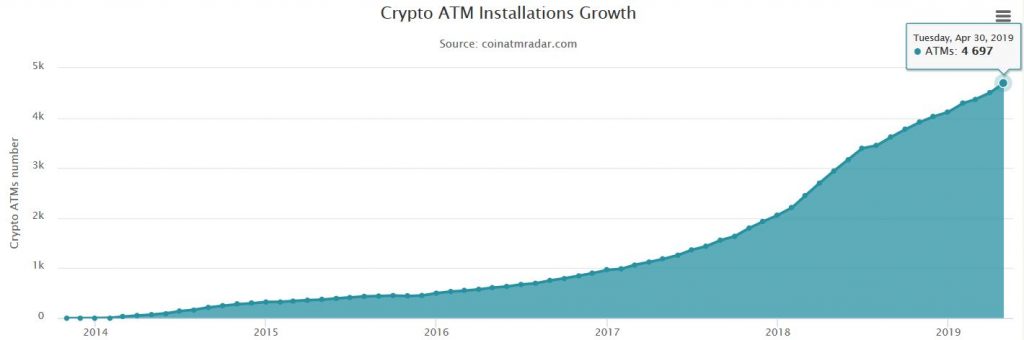

1. Crypto ATMs are popping up everywhere

Little-known fact: over the past few years, the number of cryptocurrency ATMs worldwide skyrocketed.

Judging by Coinatmradar.com global estimations, there are now 4580 crypto ATMs in 77 countries. Even though the majority of them are for Bitcoin, around 1200 of them are actually Bitcoin Cash (BCH) ATMs.

On top of that, more crypto ATMs are coming live – 6.3 per day, to be exact.

Check if the number changed, or if you’re interested in more statistics like this.

The graph below shows that on January 1st, 2018, a total of 2060 ATMs were scattered around the world. It is more than two times less than it is at the time of writing. And just two years earlier, in 2016, there were only 501.

Apparently, the ATM machine business is booming, and the market is as active as it ever was. According to a B2B market research firm’s Marketsandmarkets report, ATM market is expected to grow from $16.3 million in 2018 to $144.5 million by 2023, at a compound annual growth rate of 54.7%.

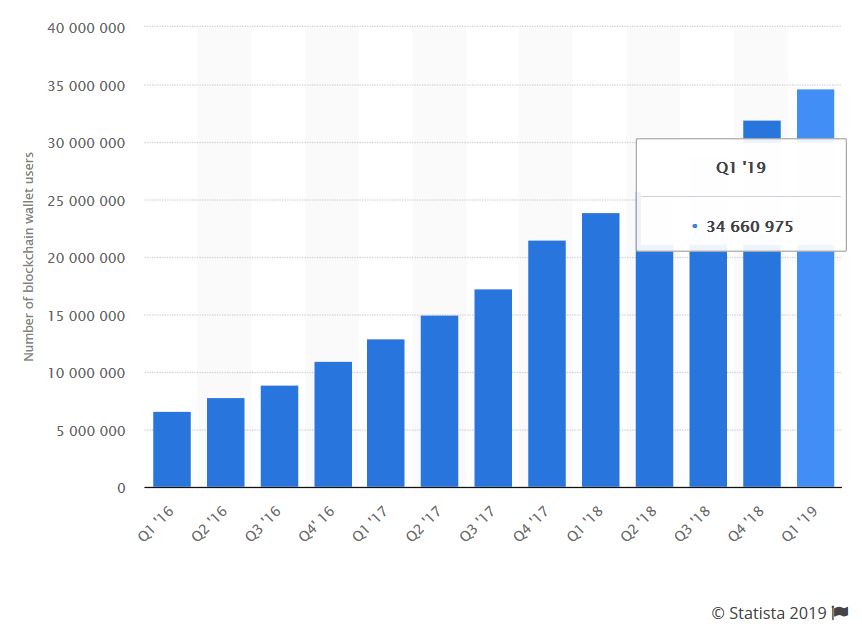

2. Bitcoin’s network is growing rapidly

Currently, Bitcoin is the most popular (and also the first) implementation of blockchain technology.

According to the data provided by statistics website Statista, there were a total of 32 million Bitcoin wallets created worldwide by December 2018.

Compared to 2017 Q4, the blockchain had 21,6 million wallets – that’s 10,4 million less. If we jump back even further, to the end of 2016, we see that there were barely 11 million wallets.

However, at the time of writing (April 2019), there are already 35 million Bitcoin wallets in existence. That’s 3 million new Bitcoin addresses in 2019 alone, climbing at a steady pace.

And let’s not forget that stats exclude those who are part of the industry, but hold a considerable amount of Bitcoin in exchanges! Sadly, there is no way to tell the exact number of people that are holding funds on custodial wallets.

But how Bitcoin is being used?

To paint a better picture, it would suffice to scout the report from the blockchain analysis company Chainalysis.

It shows that the active Bitcoin owners (mostly traders) control around 34% of the total Bitcoin supply and represent a liquid part of the market, whereas approximately 30% is set aside for long-term investments.

Fun Fact: the rest 36% consists of lost and unmined coins. Learn how not to lose your coins.

3. Merchant adoption: Starbucks, Rakuten, Kroger will accept crypto

Interestingly, the same report states that 11% of the total liquid Bitcoin is used for transacting or making payments. Yet another survey, this time by Kaspersky Labs, supports the fact by concluding that 13% of all Bitcoin users paid with Bitcoin for goods or services at least once.

Hence merchants see the opportunity. Coinmap data confirms that the number of vendors accepting Bitcoin has surged by more than 700% within the last six years, and that’s mostly brick & mortar stores. A constant merchant adoption shopper’s interest leads to massive companies wondering if they should also get on board.

Let’s take a look at some of these names:

- Japan’s biggest e-commerce giant Bic Camera/Rakuten with a market capitalization of over $12.5 bln is about to launch its own cryptocurrency exchange and wallet. Rakuten also plans to launch a phone app that would provide wallet users the opportunity to trade “virtual currency anywhere”;

- Switzerland’s biggest online retailer Digitec Galaxus now accepts 10 cryptocurrencies (including Bitcoin, Ethereum, XRP) as a form of payment for their range of 2.7 million products.

- Fortune 500 company Avnet, one of the biggest distributors of electronic components in the world, announced that their customers can now pay with Bitcoin and Bitcoin Cash. Currently, Avnet is the third largest technology company in the U.S. (after Microsoft and Dell) to accept payments in Bitcoin;

- The 2nd largest retailer in the U.S., Kroger drops Visa due to excessive transaction fees and considers Bitcoin’s Lightning Network as a possible alternative. Although it is not a sure thing yet, Kroger’s interest in digital assets will likely manifest into actions;

- Even though Starbucks didn’t confirm that it will accept Bitcoin, its open support for cryptocurrency trading platform Bakkt allows presuming it’s just a matter of time.

Our two cents

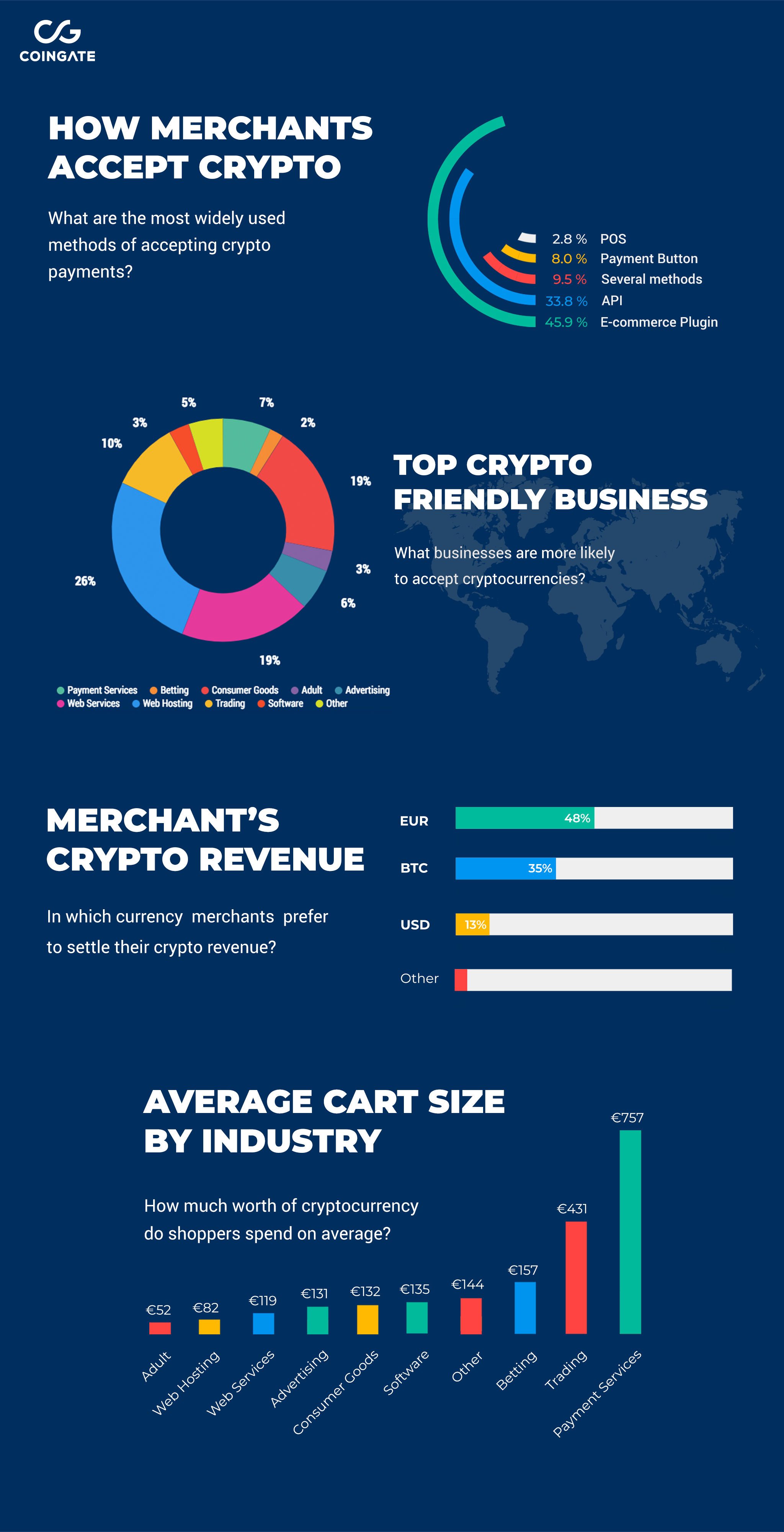

We, as a crypto payment processor, can only justify the increase of both vendor’s and shopper’s interest in using digital assets by sharing our own numbers.

During 2018, we processed close to 300,000 payments, which is three times more than all the previous years combined. Besides, we welcomed over 41,000 new users who showed interest in becoming part of this emerging industry.

Still, we certainly expect more and more vendors to adopt crypto payment options, and more regular users to embrace digital money as a reasonable way of creating a healthy market.

With that in mind, we’ve started the #CryptoRecycle movement, encouraging to spend cryptocurrencies rather than #hodl, as well as pushing for more vendors to accept digital currency payments.

– – – Learn more about the # CryptoRecycle initiative – – –

Here is more of what we have to share from CoinGate about crypto payments:

Please include attribution to CoinGate with this graphic.

Share this infographic on your site – just copy and paste it!

4. Nasdaq soon launches Bitcoin futures

This one is major and likely the most significant event to look out for these coming weeks.

The 2nd biggest stock exchange in the world Nasdaq is about to launch Bitcoin futures trading on their platform. In fact, Nasdaq already added Bitcoin and Ethereum indices to their data system, providing prices calculated in real-time.

This is a massive step forward for Bitcoin in several ways.

Firstly, Nasdaq’s total market value is around $10 trillion. Since futures contracts are exchange-traded, Bitcoin should expect some sort of a boost once the futures go live.

Secondly, Nasdaq brings Bitcoin to a broad range of investors in the most transparent, regulated way, and eventually, other markets will follow the trend.

In short, futures contracts provide a way for traditional stock market investors to buy or sell Bitcoin (in other words, bet on its future price) in the form of physically delivered contracts.

Futures also allow betting on successful Bitcoin development without ever interacting with the digital asset itself, or worrying about the security of funds.

But most importantly, futures create an opportunity for institutional investors to invest in cryptocurrency without any regulatory restrictions that would apply in common investment conditions, such as buying Bitcoin itself on a regular crypto exchange.

Nasdaq also revealed that it has partnered with investment management firm VanEck to “bring a regulated crypto 2.0 futures-type contract” sometime in 2019. The industry has been keenly waiting for more details ever since.

– – – Learn how Bitcoin futures contracts work – – –

5. You can actually pay taxes in Bitcoin

Sounds way ahead of its time, but it’s true.

The US state of Ohio became the first one allowing businesses to pay taxes in Bitcoin through the OhioCrypto platform. The state even considers adding more cryptocurrencies in the future.

But that’s not the only way Ohio pushes for blockchain adoption. It is also a state that legally recognized the blockchain as a means of data storage and transacting. It means that all electronic signatures and smart contracts recorded on the blockchain has the same legal standing as any other form of validation.

Besides Ohio, few other US states have also considered allowing tax payments in digital currency. For example, in March 2018, Illinois also proposed to enable its residents to pay their taxes in Bitcoin. Back in February, Georgia state was also considering such an option.

In fact, states like New Hampshire, Indiana, California, and Arizona, all consider legislation for making cryptocurrency tax payments legitimate.

Individual states showing initiative to legitimize Bitcoin and avail of the blockchain tech is nothing less than a sign of immense potential. Although paying taxes in Bitcoin is not widely popular right now, the situation can change seemingly overnight.

6. National cryptocurrencies emerge

Surprisingly, several countries adopted the blockchain technology by creating state-issued digital assets as early as 2015. Meanwhile, others have dedicated their time to studying it or experimenting.

Currently, four countries already issued their own national cryptocurrencies:

- The Marshall Islands. A small island with a population of roughly 53,000 has released its own token named “sovereign” (SOV) in March 2018. It is deemed the world’s first sovereign cryptocurrency that completely replaces the previously used U.S. Dollar. The coin has been created in partnership with Israeli fintech startup Neema.

- Senegal. In 2016, Senegal’s local bank Banque Régionale de Marchés (BRM) together with Ireland-based startup eCurrency Mint Limited issued blockchain-based currency eCFA. The coin is designed to work with current mobile money systems, whereas the central bank controls the supply of issued coins. It successfully suffices as a legal tender and complements paper money.

- Venezuela. Since February 2018, Venezuela launched its oil-backed digital asset called “Petro”. According to the officials, each coin represents a barrel of oil that the country owns. Eventually, Venezuela plans to issue more digital assets backed by the country’s gold and mineral reserves. And just recently, Venezuela’s government also launched the crypto remittance service, further pushing for national crypto adoption.

- Tunisia. This African country is first in the world to issue blockchain-based national currency back in 2015 called eDinar. It enables users to make instant mobile money transfers, pay for goods and services, send remittance, pay salaries and bills, and even manage official government identification documents. However, the eDinar is centralized and the central authority strictly controls it.

It is likely that in the future, more countries will avail of blockchain technology and create their own solutions. In fact, some nations officially declared that they are planning to do so.

Norway, Sweden, the United Kingdom, Canada, China, Israel, Thailand, Russia. All these countries have laid down their intentions to explore the technology. Some strongly consider creating digital currencies that would complement existing payment channels and act as legal tender.

Even though digital assets issued by governments are not that appealing for crypto enthusiasts in general, it is still a sign that the technology’s potential is vast enough not to be ignored by the authorities.

7. Big banks are taking advantage of the blockchain tech

Another critical reason why crypto is heading towards broader adoption is that the major banks say so.

From forming groups dedicated to the exploration of blockchain possibilities to actually using digital assets for their operations, these banks involved themselves into the crypto space with the clear intention to leverage the technology.

Here’s what banks are up to:

- HSBC bank says that it has settled $250 billion worth of forex trades in 2018 using blockchain technology, totaling 150,000 payments. The bank continues to praise the technology, claiming “it has automated manual processes, reducing its reliance on external technology. It also lowered the risk of errors and delays, cut costs, and helped the bank to optimize its balance sheet better.”

- Just recently, the IMF and World Bank launched a private blockchain and Learning Coin. Although it’s created to research and understand the technology and its capabilities better, they still use it internally and plan to extend its functionality beyond. For example, for paying rewards to employees, combating money laundering or even issuing smart contracts in the future;

- IBM payment network World Wire might serve 6 international banks as they all signed letters of intent to issue fiat-backed stablecoins on Stellar blockchain. World Wire intends to reduce costs and speed of remittances and foreign exchanges for regulated financial institutions;

- JPMorgan has developed its own JPM Coin on Quorum blockchain. The token aims to replace wire transfers for international payments, cut settlement times to the fraction of second and provide an instant settlement for securities issuance. According to the bank, the JPM Coin could eventually become currency for payments via mobile.

- Over 100 European financial institutions formed a new blockchain association, including participants like SWIFT, Ripple, IBM, R3, Barclays, BBVA, and many more. The new group will promote the adoption of blockchain technology, firstly by creating a framework for regulators and policymakers, as well as developing best practices and guidelines.

8. 5th AML Directive is coming to Europe

The government’s interference in crypto space might bother some people. Still, it’s inevitable if it ever wishes to expand its reach and destigmatize itself from common misconceptions.

Thus a clear regulatory framework, starting from companies that provide cryptocurrency-related services, might as well be the crucial step to making digital assets more transparent and appealing for businesses and investors to avail of.

The 5th AML Directive adopted by the European Commission in May 2018 is pursuing precisely that. We will witness the first changes in Europe on the 1st of September, 2019 until it goes into full effect on the 10th of January, 2020.

New regulations will prompt service users to disclose their identity to the service provider as a preventive measure against illicit activities. Herewith, the service providers must protect this data at all costs and implement all necessary compliance procedures.

It should establish a precedent how governments fight terrorism financing, money laundering and other fraudulent behavior in crypto space without interfering with technological progression.

– – – Learn how the 5th AML Directive impacts the crypto industry – – –

9. Bitcoin shows signs of becoming a global reserve currency

It is hard to predict whether Bitcoin will eventually become a global reserve currency or not. Some might even argue that it is not suited for it.

Nonetheless, signs show that Bitcoin is slowly becoming precisely that.

Just recently, in February of 2019, Paraguay has bought pesticides and fumigation products from Argentina. The very first cross-border export deal worth $7,100 in Bitcoin marked a historical date for the most popular digital asset to date.

Moreover, Russia intends to replace part of its U.S. Dollar reserves with Bitcoin at some point in the future. The Central Bank of Russia is yet to publish official plans, but it’s clear that one way or another, Russia will acquire some Bitcoin as part of its economic diversification strategy.

Spain is also among countries that indulged in such discussions similar ideas after the country’s second-largest bank, BBVA blocked the accounts of thousands of Chinese nationals. It led to many voices suggesting that in this kind of situation, Bitcoin presents itself as an attractive alternative for a global reserve currency.

The fact that people start talking about it and even considering Bitcoin as a candidate for a global reserve currency is already a considerable achievement for a public blockchain.

Only time will tell whether it manifests into something bigger.

10. Popular digital assets gain more scalability solutions

Lastly, for any digital asset to reach mass adoption, its network has to be scalable enough to carry out a massive amount of transactions. However, not all blockchains scale the same way. Some have a harder time than others, particularly those that use Proof-of-Work protocol.

For example, in the very beginning, Bitcoin could process only 7 transactions per second. That is why the second layer protocol called the Lightning Network (LN) was implemented along the way. The same idea was applied to Litecoin as well, and similar solutions for other blockchains started to surface soon enough.

Lightning Network enables much faster and cheaper transactions in high volumes between users, without the need for network confirmations.

– – – Learn how Lightning Network payments work – – –

Still, the solution is still in early development and is not yet well-suited for elaborate enterprise needs. However, companies like Lightning Labs are working on further upgrades to LN.

One of them is the Lightning Loop, a non-custodial service that simplifies the way you receive transactions on LN. According to Lightning Labs, it’s beneficial in several ways:

- Allows acquiring inbound channel liquidity from arbitrary nodes on the LN;

- Depositing funds to a Bitcoin on-chain address without closing active channels;

- Paying to on-chain fallback addresses is possible in the case of insufficient route liquidity.

In addition, Lightning Labs is working on Neutrino, a light client “that enables users with mobile devices to conduct blockchain and Lightning Network transactions quickly and easily.”

Speaking of the scalability of other Proof-of-Work blockchains. Ethereum will soon have a new consensus algorithm coming up with Casper. Meanwhile, the Lightning Network will get Raiden and a scalability improvement for smart contracts with Plasma.

Slow, but steady adoption

The bigger picture certainly indicates that blockchain-based digital assets are going to get mainstream one way or another. Hardly anyone would argue that technological progress wouldn’t leave an impact on the future of the global monetary system.

The only question remains – how it will all shape up at the end?

Accept crypto with CoinGate

Accept crypto with confidence using everything you need in one platform.