Accept crypto with CoinGate

Accept crypto with confidence using everything you need in one platform.

Crypto Payments for Freelances: Is Freelancing for Bitcoin Worth It?

In a world where the internet exists, finding a job as a freelancer or a digital nomad is easier than ever before, no matter if you’re a writer, designer, programmer, or else. And now, thanks to digital assets, you have even more freedom and flexibility.

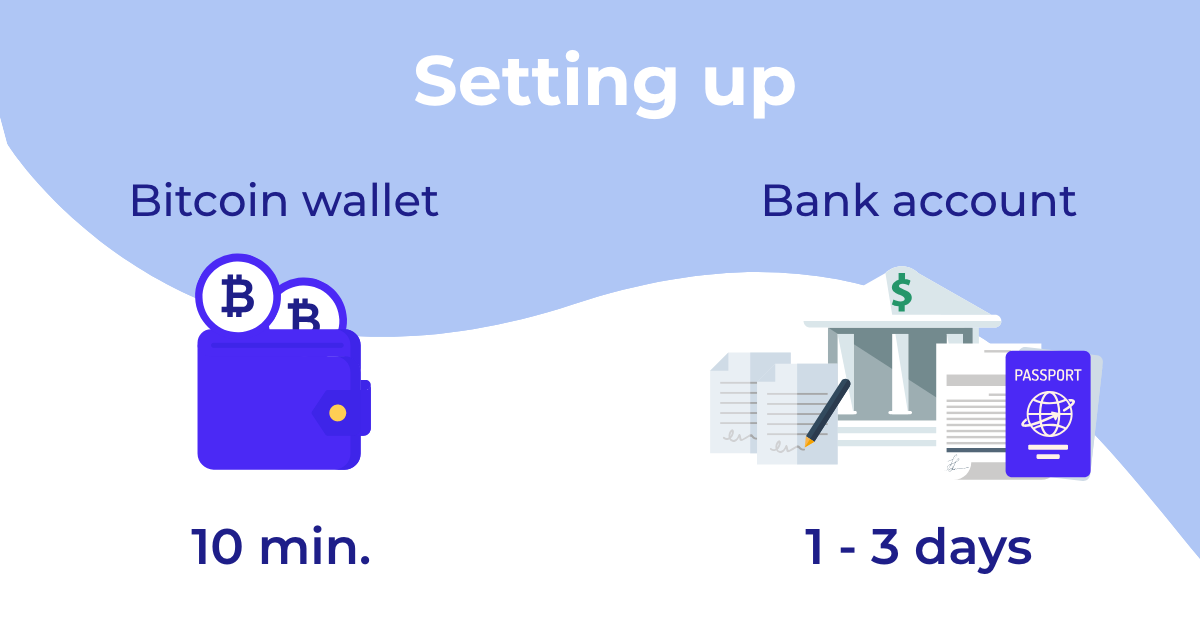

In fact, ever since Bitcoin came along, you don’t even have to open a bank account to start working. All you need is an internet connection and a Bitcoin wallet which anyone can create in a minute. Have those two, and you are ready to get your wage from all corners of the world.

This is a huge opportunity for an estimated 1.7 billion adults worldwide that don’t have a bank account to connect with a global job market.

Better for everyone, not only the unbanked

But, despite that, it is also a way to get paid fast and save money on remittance and currency conversion fees that would otherwise apply if you, in fact, would use banking or money transfer services.

Thus, there is no surprise why a recent survey by a job platform Humans.net shows that 18% of remote workers prefer receiving a salary in digital currencies such as Bitcoin and Ethereum over fiat, whereas another 11% gladly take partial wages in crypto.

This is good news for everyone, not only the unbanked. Evidently, any freelancer can benefit from what the blockchain has to offer, and there are plenty of tools that you can use.

We will come to those soon, but first, let’s find out why getting your salary in Bitcoin (or any cryptocurrency for that matter) is a brilliant idea to consider.

Bitcoin is easy to receive from a foreign country

In some regions, using PayPal (which charges 3% for each received payment) or platforms like Upwork is the only way a person can receive payments from abroad. However, such services do not provide services in all world countries. As a result, many freelancers cannot work with clients from certain continents, not to mention the possibility of payment delays or frozen accounts.

If you are a digital nomad, you might face yet another issue. When opening a bank account abroad, you might need to have a job already or provide utility bills, which might not always be possible. Also, taking care of the endless paperwork just to receive a payment via traditional payment channels can be too time-consuming, especially for those who work on their own schedule.

On the other hand, Bitcoin is easy to receive from anywhere in the world. You and your employer can be separated by a thousand miles, and you can still get paid in minutes. For that, you need only your Bitcoin address or QR code, and that’s it – no paperwork required.

Bitcoin reduces remittance and currency conversion fees

If a freelancer has a deal with an employer via a standard freelance website, it will take 10% cut (sometimes even more) and five business days for a wage to clear out. The amount might also include additional fees for currency conversion. In this case, Bitcoin can serve as the international currency, meaning you will never have to convert it to something else when paying or receiving it.

Employers can also use money transfer services like Western Union, which would result in faster delivery, but would still have a considerable fee added. However, if you would choose to accept payments in Bitcoin, the only fee that would incur is miner’s fee that is far lower compared to all other options.

It’s a win-win situation – you can get your full salary quickly from anywhere while the employer saves time and money when handling your payroll.

And, if you would employ a crypto payment provider such as CoinGate, you could benefit from cryptocurrency payments even more.

Accepting more cryptocurrencies, generate invoices, and more

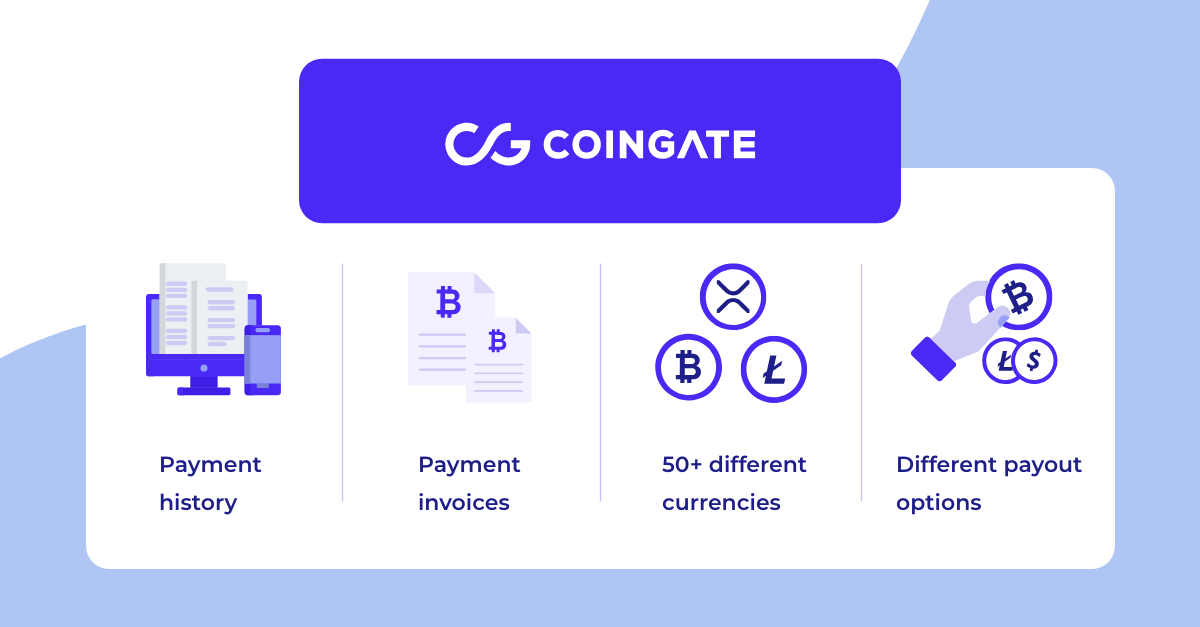

Let’s assume you are working on your own, and sometimes, you want to get paid in cryptocurrencies. How can a crypto payment processor like CoinGate can help out in this situation? Let’s review what is possible:

- Accept +70 cryptocurrencies at once. Your employer might want to pay you in a different digital asset than Bitcoin. Luckily, it is not a problem as you can automatically convert any other cryptocurrency earnings to Bitcoin or fiat currency as long as you use a crypto payment provider.

- Control your settlements. Once you have the option to accept various digital assets, you also obtain an ability to customize your invoice options and decide how you want to proceed with your crypto earnings. For example, you can convert all collected cryptocurrencies to fiat, settle to other coins, or keep what you get. Learn more about the invoice customization.

- Generate payment invoices. We offer different crypto payment integration methods that generate invoices automatically. In other cases, you can use our payment buttons for email invoicing. Simply create a button and send a link to a person who wants to pay you. You would be able to include all the required information in the payment button description, whereas your employer would be able to choose from a list of available assets to pay you.

- Choose the payout option you prefer. You can withdraw your funds weekly via SEPA/international SWIFT bank transfer, also to Skrill wallet or AdvCash platform. There are also options to convert earnings to Bitcoin, Ethereum, Litecoin, or Bitcoin cash, and send them to their dedicated wallets.

- Track and review the history of payments. Every single invoice (paid or not) would appear on your account dashboard. You can always review and export the information if needed, also sort invoices by date, payment status, ID, and other variables.

What crypto payment integration methods do you offer?

We offer several ways to collect cryptocurrency payments, depending on what suits the customer best. Learn more about our integration methods in this article.

What to do with earned Bitcoin

Let’s assume you get paid in Bitcoin. What comes next?

Well, you can spend it at shops that accept it (you can find plenty right here on our blog), or you can convert some or all of your earnings to the local fiat currency at an exchange.

Alternatively, you can obtain fiat currency via services like CoinGate that allow selling Bitcoin for fiat and sending money straight to your bank account or the Skrill wallet.

Start accepting crypto as a freelancer today

It is always useful for a freelancer or digital nomad to have additional measures for getting paid, especially when it is so easy to set everything up. It is also an excellent opportunity to dip your feet into the crypto world.

In fact, you can start right away by creating an account on CoinGate. Give it a go!

Do you like our content? Then subscribe to our blog! Write your email at the bottom of a page and you will never miss another story from us!

Accept crypto with CoinGate

Accept crypto with confidence using everything you need in one platform.