Accept crypto with CoinGate

Accept crypto with confidence using everything you need in one platform.

Is Ondato Safe? - Learn About Identity Verification Services

The surge of online transactions and interactions has brought with it an unprecedented challenge: establishing and maintaining trust in an increasingly anonymous world. This landscape is where the crucial role of identity verification services emerges.

As the digital economy grows, it’s becoming easier for fraudulent activities to slip through the cracks. Identity theft, financial fraud, and data breaches are rampant, posing significant threats to both businesses and consumers.

In this context, verifying the identity of individuals engaging in various online activities is no longer a luxury – it’s a necessity.

Let’s explore the integral role identity verification plays and the diverse problems it addresses, as well as take a close look at the Ondato services as a perfect example of a fully-fledged ID verification system.

See how Ondato leveraged cryptocurrency payments to cater to their client’s evolving preference of paying with digital assets in our case study.

Introduction to Identity Verification Services as The Bedrock of Secure Business Operations

Whether it’s financial services, insurance, the sharing economy, telecommunications, gambling, or legal industries, identity verification stands as a bulwark against fraud and ensures seamless customer transactions.

The Growing Necessity of ID Verification in Various Sectors:

- Financial Services: With increasing digital banking and online financial transactions, identity verification is crucial for preventing fraud, money laundering, and ensuring compliance with global banking regulations.

- Insurance: It helps in authenticating individuals’ identities, reducing the risk of fraudulent claims, and ensuring that services are offered to eligible customers.

- Sharing Economy: Platforms like Airbnb and Uber rely on identity verification for the safety and trust of their users, ensuring that both service providers and consumers are who they claim to be.

- Telecommunications: As providers handle sensitive customer data, identity verification is vital for securing accounts and preventing identity theft.

- Gambling: Online betting platforms use identity verification to adhere to legal age limits and regulatory compliance, as well as to prevent fraud.

- Legal Sector: Ensures that legal services are provided to legitimate clients and helps in the prevention of activities like money laundering.

Addressing Modern Challenges

Identity verification services are not just a response to regulatory demands; they are a proactive measure against an array of modern challenges:

- Fraud Prevention: In an era where identity theft and financial fraud are rampant, these services provide a critical defense mechanism.

- Enhancing User Experience: Seamless and efficient verification processes improve customer onboarding, enhancing overall user satisfaction.

- Global Compliance: With varying international regulations, identity verification services help businesses stay compliant in different jurisdictions.

- Trust Building: They are instrumental in building a foundation of trust between businesses and their customers, a crucial factor in the success of online platforms.

- Data Security: In a time when data breaches are common, robust verification processes ensure the security of sensitive personal information.

The role of identity verification services extends far beyond regulatory compliance. They are a vital component of any modern business operation, playing a critical role in securing transactions, building trust, and enhancing customer experiences.

Ondato Pioneering KYC and AML Solutions

Ondato stands at the forefront of the identity verification industry, offering a holistic approach to KYC (Know Your Customer) and AML (Anti-Money Laundering) compliance.

This section will provide a more comprehensive introduction to Ondato, showcasing why it’s a game-changer in the realm of digital identity verification and compliance.

What Sets Ondato Apart?

- Innovative KYC Compliance Platform: Ondato OS is not just a tool but a comprehensive platform, integrating all necessary KYC and AML tools in one interface. This integration simplifies the process of client identity verification, ensuring thorough and efficient compliance.

- Wide-Ranging Solutions: Whether it’s digital identity verification, AML screening, lifecycle management, or data validation, Ondato offers a suite of solutions, making it a one-stop shop for all compliance needs.

- Cost-Effectiveness: Ondato’s technology is designed to significantly reduce KYC-related costs – by up to 90%. This reduction is a game-changer for businesses looking to optimize their budget without compromising on compliance and security.

- Simplified Internal Processes: The platform streamlines internal workflows, saving time and resources. This efficiency is crucial in today’s fast-paced business environment, where time equates to money.

- Customizable Compliance Rules: Recognizing that every business has unique needs, Ondato allows clients to set their rules for onboarding and lifecycle management, offering unparalleled flexibility.

- Global Regulatory Adaptability: Ondato’s platform is continually updated to stay in line with regulatory changes across different jurisdictions, ensuring that businesses remain compliant no matter where they operate.

- Advanced Fraud Prevention Techniques: With a focus on security, Ondato employs sophisticated methods for preventing identity fraud, thereby safeguarding both businesses and their customers.

We invite readers to explore Ondato’s capabilities by trying out their demo. This hands-on experience will provide an insight into the platform’s ease of use, efficiency, and comprehensive nature.

Furthermore, as we delve deeper into Ondato’s services in the subsequent sections, readers will gain a fuller understanding of how Ondato’s innovative solutions can be instrumental in transforming their approach to digital identity verification and compliance.

With Ondato, businesses can navigate the complexities of identity verification with ease, ensuring compliance, reducing costs, and enhancing overall operational efficiency. Stay tuned as we take a deep dive into the specific services and benefits that Ondato offers.

Deep Dive into Ondato Identity Verification Services

Let’s take a look at the various facets of Ondato’s services, highlighting their global reach, efficiency, accuracy, and innovative approach.

Global Reach and Rapid Onboarding

Ondato’s services span across 192 countries, demonstrating its capacity to handle diverse global compliance requirements. This vast reach is crucial for businesses operating in multiple jurisdictions or planning to expand internationally.

With an average onboarding time of just 60 seconds, Ondato significantly reduces the time taken for customer verification processes. This efficiency enhances user experience and accelerates business operations.

Comprehensive Database and Document Support

Access to over 15,000 global AML sources ensures that businesses using Ondato stay ahead of compliance and regulatory requirements, no matter how complex or varied.

The ability to support over 10,000 documents underlines Ondato’s commitment to versatility and inclusivity, accommodating a wide range of identification needs.

Precision and Reliability in Verification

Ondato’s 99.8% accuracy rate in verification processes reflects its commitment to precision, ensuring that the data and verifications are reliable and trustworthy.

A 94% average pass rate signifies the platform’s effectiveness in balancing stringent compliance measures with a user-friendly verification process.

Tailored Services for Diverse Needs

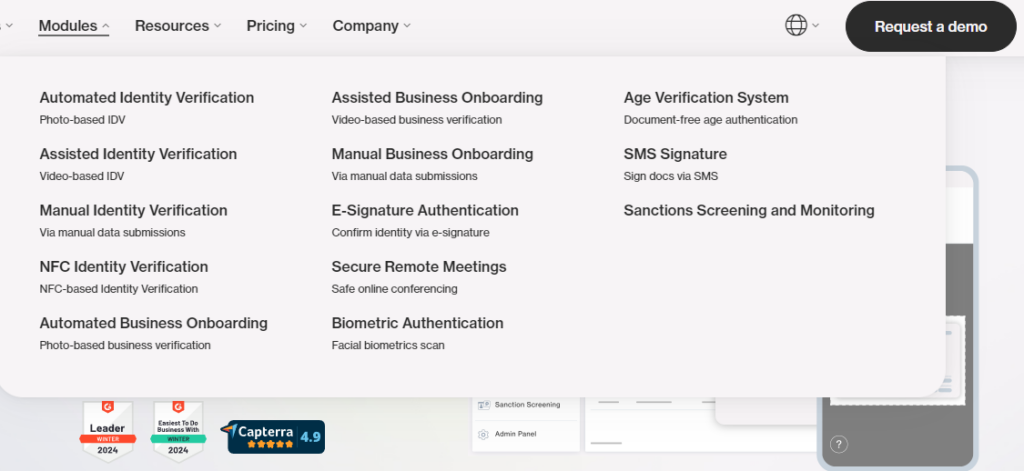

Ondato’s suite of services is tailored to meet the varied requirements of businesses in different sectors:

- Automated and Assisted Identity Verification: Both photo-based and video-based IDV options cater to different levels of verification needs, offering flexibility and choice to businesses.

- NFC Identity Verification: This NFC-based solution represents the cutting edge in verification technology, providing an additional layer of security and convenience.

- Business Onboarding Solutions: Automated, assisted, and manual options for business verification underscore Ondato’s adaptability to various business models.

- E-Signature and SMS Signature Authentication: These tools offer secure and innovative ways to confirm identities and sign documents, enhancing both security and user experience.

- Biometric Authentication: Facial biometric scans provide an advanced level of security, crucial in the current digital landscape.

- Secure Remote Meetings: This feature ensures the safety of online conferencing, a necessity in today’s remote working environment.

- Sanctions Screening and Monitoring: Constant updates and monitoring keep businesses compliant with the latest global sanctions and regulatory changes.

The services offered by Ondato represent a comprehensive, efficient, and technologically advanced approach to identity verification and compliance.

With its global reach, rapid onboarding, extensive AML sources, document support, and a wide array of innovative services, Ondato stands as an essential and capable partner for businesses seeking to navigate the complex world of KYC and AML compliance.

The next section of our blog will explore the real-world applications and testimonials of Ondato’s services, showcasing its impact and effectiveness.

Real-World Success Stories with Ondato

Ondato’s capabilities are best illustrated through the experiences and successes of its diverse clientele.

Let’s explore some impactful case studies that showcase how Ondato’s innovative solutions have revolutionized identity verification and compliance processes for various organizations.

LKU Case Study: Empowering Credit Unions with Streamlined Solutions

LKU, a prominent credit union group in Lithuania, unites 45 credit unions offering a wide array of services including electronic banking, international money transfers, and more. With such a broad spectrum of services, the need for efficient and reliable identity verification processes was paramount.

The primary challenge for LKU was to implement a robust identity verification system that could efficiently handle the diverse needs of their credit unions while ensuring compliance with regulatory standards.

Ondato stepped in with its comprehensive KYC and AML solutions, offering a streamlined process tailored to the specific requirements of each credit union within the group. This solution significantly enhanced the efficiency of their services, reduced operational costs, and ensured regulatory compliance across all operations.

Ondato’s solution not only streamlined the identity verification process but also brought about a significant reduction in KYC-related costs. The implementation led to improved customer satisfaction due to the swifter and more efficient service delivery. You can read more about this particular case study here.

OnlyFans Case Study: Enhancing Digital Media with Secure Verification

OnlyFans, a UK-based digital media platform with over 220 million users, focuses on empowering creators to control their content and benefit financially.

The challenge for OnlyFans was to establish a secure and reliable system for identity verification that would protect both creators and users, aligning with their mission of empowerment and control.

Ondato provided a comprehensive identity verification solution that catered to the unique needs of the digital media platform. This included advanced security measures to protect user data and ensure the authenticity of the creators on the platform.

The implementation of Ondato’s solutions heightened the security and trustworthiness of OnlyFans, fostering a safer and more controlled environment for content creators and their audience. This step was crucial in enhancing user experience and maintaining the platform’s integrity.

HeavyFinance Case Study: Securing Investments in Agriculture

HeavyFinance operates as a bridge between investors and agricultural enterprises, focusing on regenerative soil management techniques. This approach requires a secure investment environment, with heavy machinery or land often used as collateral.

The primary challenge for HeavyFinance was to ensure the authenticity and reliability of the participants on their platform, thereby safeguarding investments.

Ondato’s identity verification services provided the necessary security and reliability, ensuring that all parties involved in the investment process were thoroughly verified. This measure was crucial in maintaining the integrity and trust of the HeavyFinance platform.

The integration of Ondato’s services enhanced the overall security and reliability of investments on HeavyFinance. It reassured investors of the legitimacy of their investments and contributed to the platform’s growth by attracting more participants who valued a secure investment environment. Learn more about HeavyFinance’s use of Ondato services.

These case studies illustrate the versatility and effectiveness of Ondato’s solutions across various industries.

From financial services to digital media and investment platforms, Ondato’s innovative approach to identity verification and compliance has not only solved complex challenges but also propelled these organizations towards greater efficiency and success.

These real-world applications underscore Ondato’s role as a pivotal player in the digital verification landscape.

Ondato’s Bitcoin, Crypto and Other Payment Methods

Ondato’s approach to payment methods mirrors its commitment to flexibility and client convenience.

Alongside traditional payment methods like invoices and bank transfers, Ondato steps into the modern financial landscape by accepting cryptocurrency payments.

For organizations that follow conventional financial practices, Ondato accepts payments via invoices. This option caters to businesses requiring systematic financial documentation and those accustomed to traditional billing cycles.

Ondato also supports payments through bank transfers, a universally accepted and secure method of transaction. This traditional mode of payment is especially beneficial for clients who prefer the familiarity and reliability of conventional banking.

In an innovative move, Ondato integrates cryptocurrency payments for their services. This decision highlights Ondato’s adaptation to the evolving digital economy and its desire to cater to a broader range of client preferences.

By utilizing a cryptocurrency payment processor, CoinGate, Ondato efficiently serves customers who prefer transactions in Bitcoin and numerous cryptocurrencies. Learn why accepting crypto payments is such a good idea, as described by crypto-friendly companies.

Ondato Pricing for Verification Services

Ondato offers various pricing plans for their services, primarily differentiated by volume and additional features. The primary plans are:

- Growth Plan: This plan charges €0.95 per verification, with an additional monthly license fee of €259. It offers basic access to Ondato’s services without an annual commitment.

- Expansion Plan: Priced at €0.85 per verification and a monthly license fee of €569, this plan is designed for larger-scale operations, providing broader access to Ondato’s features.

- Enterprise Plan: This is a custom plan tailored to the specific needs of larger businesses. Pricing and features are customized based on individual requirements.

Each plan includes a set of core services, with options for additional features and services at extra costs. For detailed information on each plan and the specific services included, please visit Ondato’s plans & pricing page.

In addition to the basic pricing structure, Ondato’s plans also include a set-up fee for new clients, which varies based on the plan chosen. Moreover, the pricing may vary depending on additional services and features that a business may require.

Reasons to Choose Ondato for Future-Proof Identity Verification

As we’ve explored the diverse array of services and real-world applications of Ondato, it becomes evident why this platform stands out in the realm of identity verification and compliance.

Let’s consolidate our insights to make a compelling case for why Ondato’s services are not just worth a shot, but are indeed a powerful and essential tool for modern businesses.

Unparalleled Efficiency and Global Reach

Ondato’s ability to operate in 192 countries with an average onboarding time of just 60 seconds is a testament to its global efficiency. This kind of reach and speed is invaluable in today’s fast-paced, interconnected business world. It allows companies to expand their operations globally without being bogged down by lengthy and complex compliance processes.

Cutting-Edge Technology and Customization

The technological prowess of Ondato, with its ability to support over 10,000 documents and access to 15,000+ global AML sources, is a game-changer. This extensive support, coupled with 99.8% accuracy and a high pass rate, shows that Ondato doesn’t just provide a service – it offers a technological advantage. Moreover, the flexibility to customize services according to specific business needs ensures that every organization, regardless of size or sector, can benefit from Ondato’s solutions.

Cost-Effectiveness and Streamlined Operations

By reducing KYC-related costs by up to 90% and simplifying internal processes, Ondato directly contributes to the financial health and operational efficiency of businesses. This cost-effectiveness, combined with time savings, allows companies to allocate resources more strategically, focusing on growth and innovation.

Enhancing Security and Building Trust

In an era where data breaches and identity theft are major concerns, Ondato’s advanced security measures provide a shield against such threats. This security fosters trust among customers and partners, a crucial element in building and maintaining business relationships in the digital age.

Proven Success Across Industries

The case studies of LKU, OnlyFans, and HeavyFinance are clear indicators of Ondato’s adaptability and effectiveness across various sectors. Whether it’s streamlining operations for a group of credit unions, enhancing the security of a digital media platform, or securing investments in agriculture, Ondato has proven its capability to tackle unique challenges and drive success.

Forward-Thinking Compliance and Fraud Prevention

Ondato’s proactive approach to regulatory changes and its sophisticated fraud prevention techniques ensure that businesses are not just compliant today, but are also prepared for future regulatory landscapes. This forward-thinking approach is crucial for businesses aiming to stay ahead in a rapidly evolving digital world.

It stands as an example of innovation, efficiency, and security in the world of identity verification and compliance. Its combination of global reach, technological prowess, cost-effectiveness, and industry-wide adaptability make it a compelling choice for any business looking to enhance its KYC and AML processes.

With Ondato, businesses are investing in a future-proof solution that promises security, compliance, and operational excellence. Ondato is more than just powerful – it’s a strategic partner in navigating the complexities of the digital age.

Sign up for the Ondato demo presentation today.

Accept crypto with CoinGate

Accept crypto with confidence using everything you need in one platform.