Accept crypto with CoinGate

Accept crypto with confidence using everything you need in one platform.

Comparing Hot Wallet vs Cold Wallet – What’s the Difference?

Every owner of cryptocurrencies needs a wallet, but how to choose the right one(s)? There are so many various types of crypto wallets it’s not always clear what’s the difference between them nor easy to decide which one will suit your needs the best.

One thing is for sure, there is something for everyone. Despite that, we can easily segment the types of digital currency wallets into two big categories: hot wallets and cold wallets (also called and known as cold storages or hardware wallets).

In this article you will find:

What is the main difference between hot and cold wallets

What are the types of hot wallets

What are custodial and non-custodial wallets

Cold wallet (storage) options

What are the cons of cold wallets

How to choose a wallet for your cryptocurrencies

What’s The Difference Between Hot and Cold Wallets

It’s quite easy to distinguish one type from another. In simple words, all wallets that are connected to the internet are considered hot wallets. Likewise, all wallets that are kept offline are cold wallets.

As such, hot wallets are perfectly convenient for everyday use (e.g., buying goods and services, transferring small amounts of crypto to friends or family, etc.), and come in the form of easily accessible software.

Contrary to hot wallets, cold storages are, in most cases, physical hardware wallet devices, designed for far more secure, long-term cryptocurrency storage for those that have significant amounts of digital assets that require strong security measures to protect.

So, it all boils down to one main difference between the two choices – the level of security.

Check out the BEST COLD WALLETS in the market!

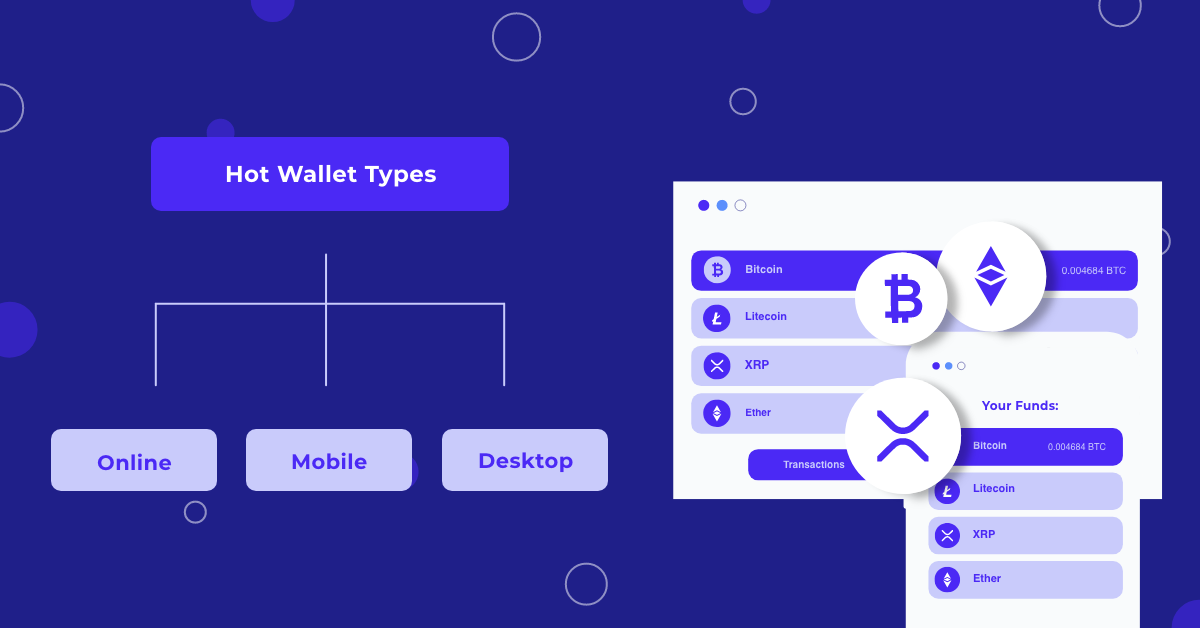

Types of hot wallets

Although there are numerous wallets that offer different features, all can be segmented into online, mobile, and desktop wallets. Basically, you’re creating a hot wallet whenever you create an account on an exchange, create a profile on a downloaded mobile or desktop wallet.

Hot wallets are the most popular crypto wallets because they are made for everyday cryptocurrency users and are easy to set up. If you live on cryptocurrencies and use them to buy everyday-use things or if you regularly trade crypto, hot wallets are probably your go-to choice. They are usually made in a user-friendly way to make your crypto transactions as easy as possible.

Mobile and desktop wallets

Online wallets run on cloud servers and can be accessed on any device with a web browser. Mobile wallets are exactly that – apps for your iOS or Android phone, whereas desktop wallets run as applications on a computer. There are crypto wallets for Linux, Mac, and Windows, some desktop wallets even support all three versions.

But, no matter which one you intend to use, all hot wallets have one thing in common – to use them, you need to have an internet-connected device, which makes them vulnerable to online theft.

The safety aspect of online wallets

If you lose your device or it gets hacked, there is a high probability that your private keys will be gone along with your crypto assets. Therefore, if you hold a large number of cryptocurrencies, it is recommended to place your holdings into a hardware wallet or keep them on a trusted exchange.

However, as long as you take precautions, your online identity and cryptocurrencies that you have should remain intact.

Lastly, when it comes to choosing the most suitable hot (software) wallet, there is another crucial aspect to consider: whether the hot wallet is custodial or non-custodial.

Custodial vs. Non-Custodial wallets

Some wallet providers do not give you access to your private keys and instead keep them on their servers. Such wallets are called custodial, meaning they do not give you full control of your funds. With a non-custodial wallet, you get full control of your funds and you are the only person who owns the private keys. They eliminate the third party between you and your crypto.

Custodial wallet cons

When you create a custodial wallet and start storing crypto in there, it probably means that an exchange you use now holds your access keys and is tasked to securely store your funds.

As a result, such wallet providers could freeze your assets if some regulatory entity would insist on it. Moreover, if such a service provider would suddenly ceases to exist or gets hacked, you would most likely lose access to your funds whatsoever.

Custodial wallet pros

On the other hand, not all crypto users are comfortable keeping the burden of security on their shoulders. So, if remembering passwords is not your strongest suit, custodial wallet providers might be a better choice.

In such a case, you have access to different tools for recovering access to the funds if something goes south for you, for example, restoring a password via email. Moreover, using 3rd party services means that some actions or mistakes could be reversed if needed, which would be impossible with non-custodial wallets.

The most popular custodial wallet examples are: FreeWallet, Coinbase, Binance, BitMex, Blockchain.com., Kraken

Non-custodial wallet pros

With non-custodial wallets, you get full control of your funds as you are the sole owner of your private keys, while the wallets themselves are generally serverless.

Even though the burden of security lies on your shoulders entirely, it is considered to be a much safer option than trusting custodial wallet providers. When using non-custodial wallets, you can be sure that no 3rd party or government agency can ever tamper with what you have or what you do on the blockchain.

Also, when your crypto wallet and your funds rely on you, there is a lower risk of a data breach. That’s the main reason why 66.5% of crypto holders are relying on non-custodial and mobile storage solutions these days.

Non-custodial wallet cons

Nothing is perfect, of course, and non-custodial crypto wallets come with some points to consider. For example, if you store your cryptocurrencies in a non-custodial wallet it will get harder to do quick currency trades as your currency will need to be sent to an exchange.

Also, for some users, the interface of a non-custodial wallet is harder to understand. Yet again, when you’re the only person who controls your private keys, it means that if you will lose them, you can lose access to your wallet without a recovery possibility.

The most popular non-custodial wallet examples are Trezor, Ledger, Wasabi, Zengo, Electrum.

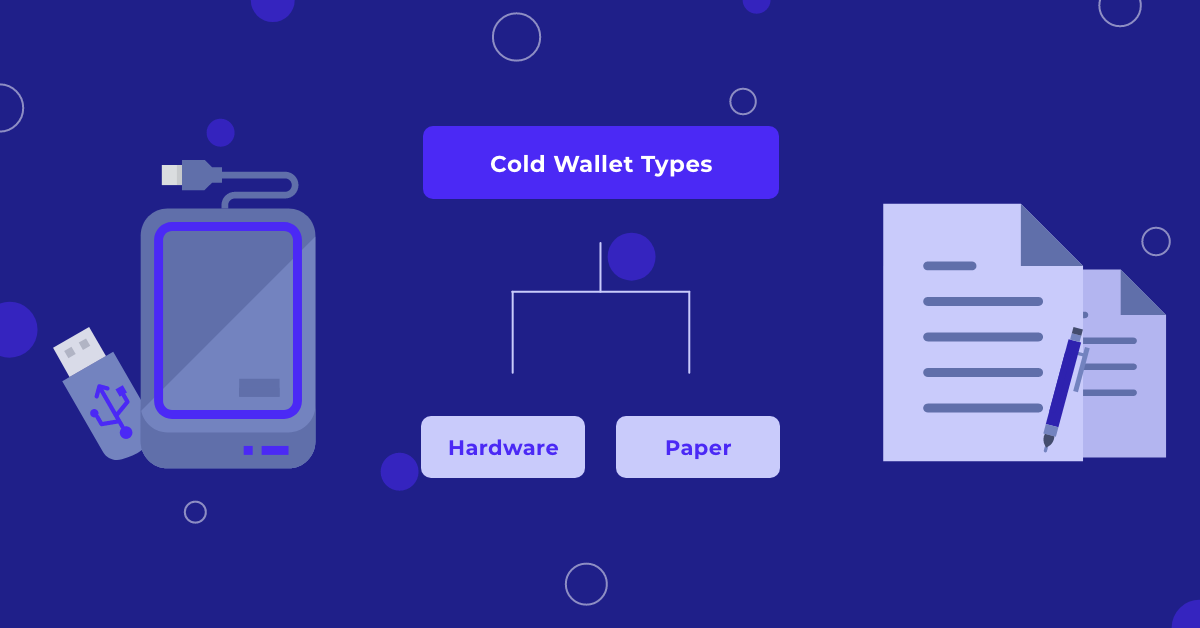

Cold wallet (storage) options

Finally, we come to the cold storage option. Unlike software wallets, cold wallets are not connected to the internet (only when you want to make a transaction) and usually come in the form of hardware similar to a USB stick. A less popular type of cold wallet is a paper wallet. A paper wallet is a piece of paper with your printed private keys and a public wallet address.

Paper wallets – what are they?

Mostly, paper wallets were used more before cryptocurrencies gained public attention and popularity, but under some circumstances, it is still a valid way to store your keys.

Paper wallets and hardware wallets function similarly. But with a first option, instead of a USB-like device, you get a piece of paper with written private keys. Some of them might also give you a scannable barcode created by an app.

In order to send or spend cryptocurrency from a paper wallet, it has to be imported into a hot wallet by a scan of your private keys.

As the security aspect goes – as long as you keep your paper wallet in a secure, fire-proof place, it does its job, even though it’s not as convenient as other options.

Hardware wallets – what are they?

As mentioned before, hardware wallets come in a form, similar to a USB stick. These encrypted and highly secure devices store your private keys entirely offline and have a PIN number as an additional security measure. Simply plug it in your computer, and you’re ready to make a transaction.

Even if someone managed to steal your cold storage device, it still wouldn’t mean that your funds are lost as the hacker would need to decrypt it and hack your PIN, which is proven nearly impossible to do.

Better-known examples of hardware wallets are Trezor and Ledger Nano.

Separate phone as a cold wallet?

It might sound weird, but some people use another phone as a crypto cold wallet. In this scenario, the second phone functions only as a wallet and is turned on only when you want to make a transaction. When it’s turned on, you connect it to your main phone via Bluetooth or WiFi and transfer a part of your funds to a hot wallet. When the transaction is done, the phone and the connection are powered down.

For some, this is a more convenient approach to store crypto funds than using a hardware wallet. It is less secure than a proper cold wallet but more secure than storing all your cryptos in a hot wallet.

The cons of cold wallets

It is known that cold hardware wallets are probably the safest way to hold your crypto, but in terms of everyday cryptocurrency use, because they have to be found, powered on, and then connected to the internet.

Also, hardware wallets are more costly, especially compared to some free hot wallet options.

When Choosing Hot Wallet or Cold Wallet you need to be wise!

In order to have the best use for your cryptos, it is recommended to combine a hot wallet with a cold wallet of your choice. While hot wallets are more functional and user-friendly, you can have them for your everyday use – trading, sending, receiving, or spending cryptocurrencies.

If you hold a larger amount of digital money, you can and probably should store them in the most secure way possible. Therefore – use cold wallets for your big crypto funds.

Picking the right wallet for your digital currencies storage is undoubtedly essential, but if you’re not sure where to start, check out our article where we share our suggestions – you might find all you need right there!

Accept crypto with CoinGate

Accept crypto with confidence using everything you need in one platform.